Is a 2024 Interest Rate Cut on the Horizon? What a Dovish Fed Means for Your Wallet

Let’s decode the Federal Reserve. It’s not the latest streaming hit, but what one official says can impact your life more than any reality show finale. When New York Fed President John Williams mentioned “room for a further adjustment” in borrowing costs, Wall Street’s ears perked up. This was a signal that the era of painful credit card statements might be ending, offering a glimmer of hope for anyone with a loan or mortgage. For the average person, this is the kind of financial gossip that matters.

Who Is John Williams and Why Should You Care?

John Williams isn’t just any suit. As the head of the Federal Reserve Bank of New York, he has a permanent seat on the Federal Open Market Committee (FOMC), the group that sets U.S. interest rates. Unlike other regional Fed presidents who rotate, Williams’s voice is a constant in the room where it happens. His comments are a trailer for the U.S. 2024 economic outlook, and when he speaks, it’s a good idea to listen.

Breaking Down the Dovish Turn: Is the Fed Easing Up?

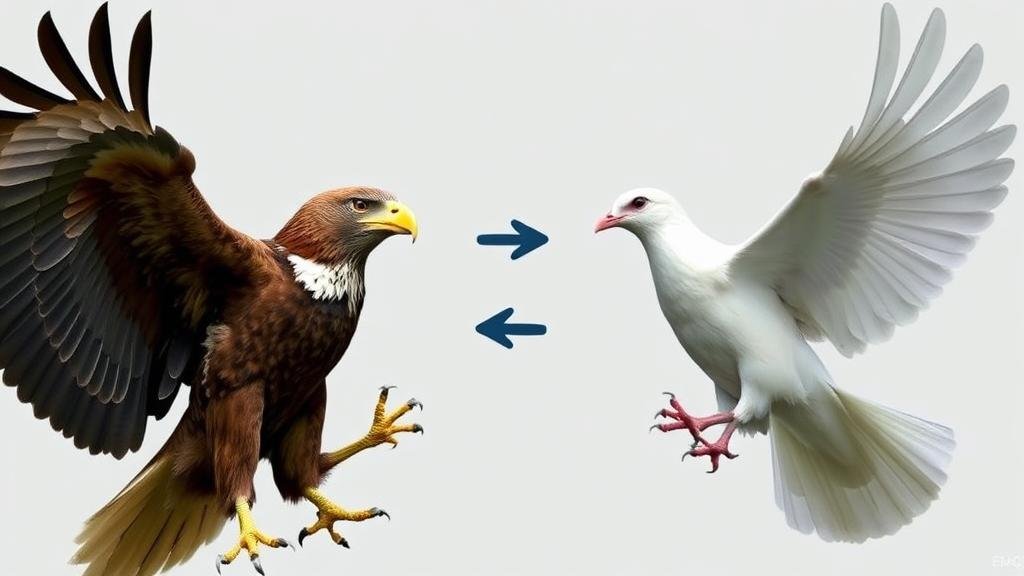

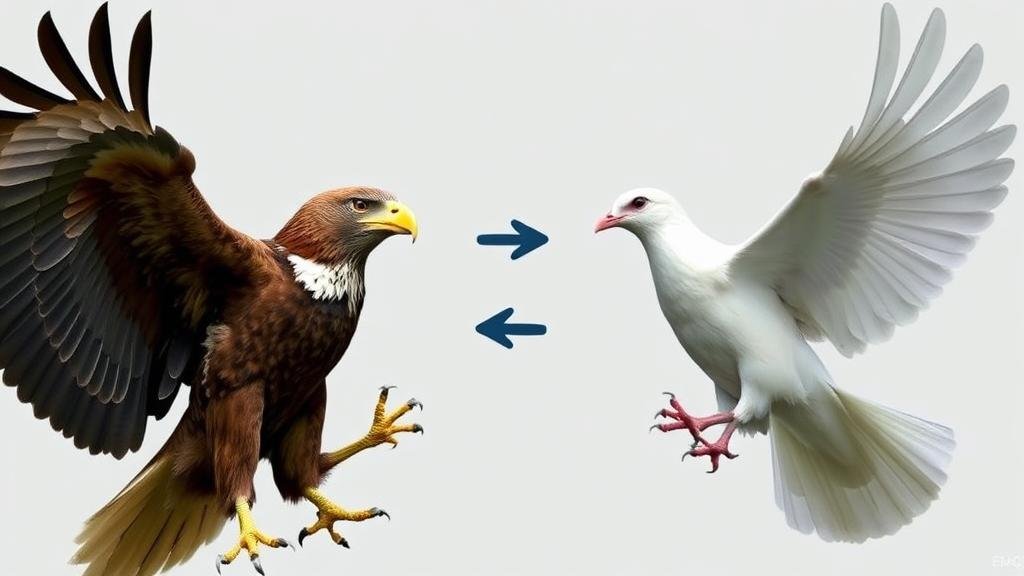

For the last two years, the Fed has been aggressively fighting inflation with a hawkish stance, hiking interest rates to levels that made borrowing for a car feel like buying a yacht. Williams’s comment about an “adjustment” hints at a dovish turn, signaling a potential policy shift.

In Fed-speak:

- Hawk: Wants to raise rates to fight inflation.

- Dove: Wants to lower rates to boost the job market.

The Fed might be trading its hawk talons for dove feathers. This whisper of a rate cut sent the stock market soaring. Why? Lower interest rates make it cheaper for companies to borrow and grow, leading to fatter profits and happier investors. Williams even suggested the bigger threat now might be a weak job market, not runaway inflation.

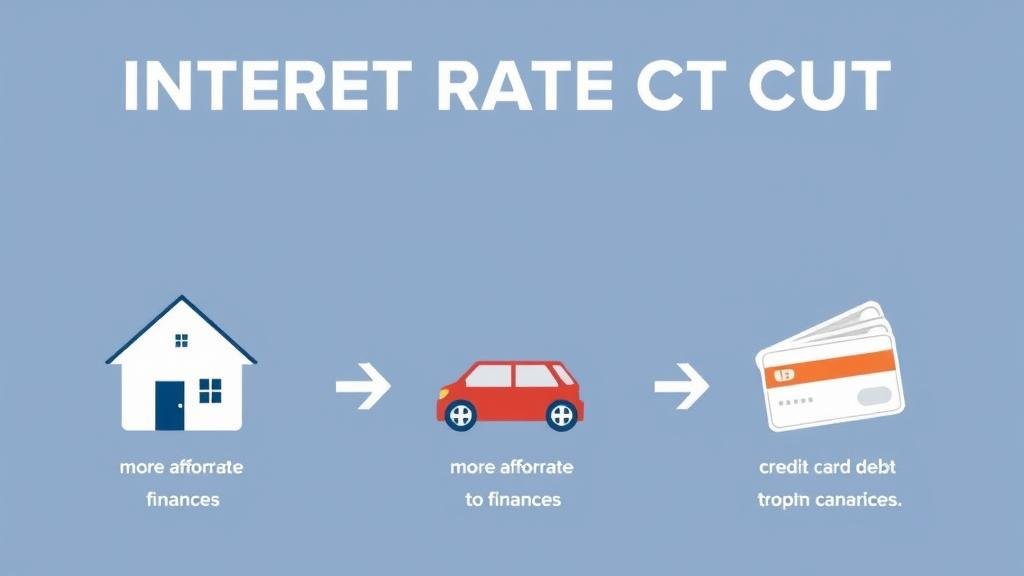

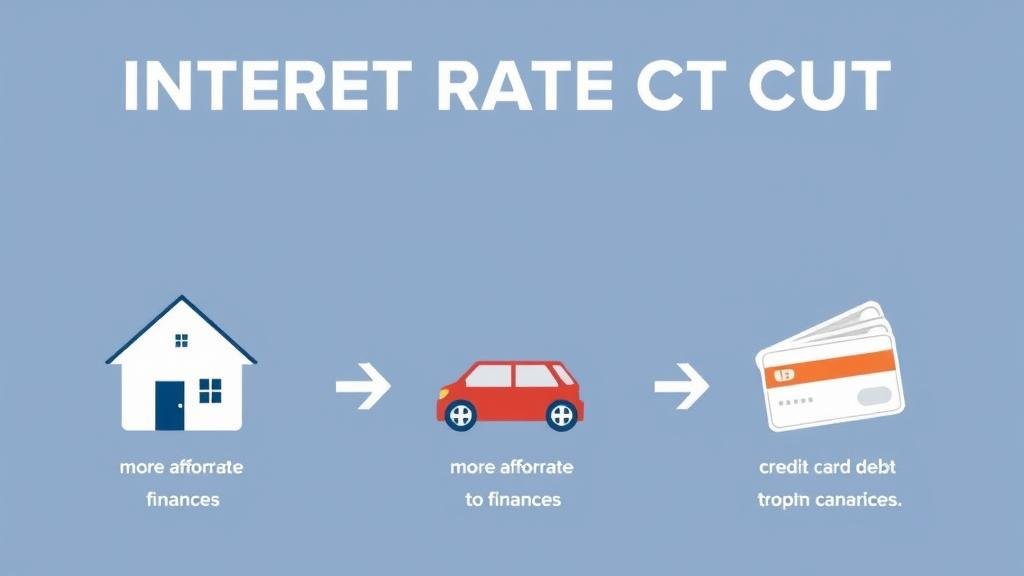

What a Rate Cut Could Mean for Your Finances

The Fed’s decisions have a ripple effect on your personal finances. Here’s a breakdown of how an interest rate cut could impact your wallet.

Mortgages

If you’re in the market for a house, a rate cut is great news. While mortgage rates are complex, they often follow the Fed’s lead. A lower rate could make that dream home with an extra bedroom more affordable.

Auto Loans

Eyeing a new car? A rate cut could lead to lower APRs on auto loans, making your monthly payments more manageable.

Credit Card Debt

This is a big one. Most credit card rates are variable and tied to the Fed’s rate.

- If you carry a balance: A rate cut will likely lower your APR, making it easier to pay down your debt.

- If you pay it off monthly: You won’t see a direct change, but a healthy economy benefits everyone.

Savings Accounts & CDs

Here’s the flip side. If you’ve been enjoying high-yield savings account rates, a rate cut means those returns will likely decrease as banks pay out less on deposits.

The Rationale: Why Cut Rates Now?

The Fed operates under a dual mandate:

- Price Stability (Fighting Inflation): The rate hikes have largely worked to cool down inflation.

- Maximum Employment (Protecting Jobs): The job market has been strong, but there are signs of it slowing. Williams is concerned that if too many people lose their jobs, the economy could slide into a recession.

By cutting rates, the Fed would be making a preemptive move to sustain the job market and ensure financial stability. As The New York Times noted, this has boosted the odds of a December rate cut.

What Should You Do Now?

John Williams’s comments have opened a window of financial optimism. While a rate cut isn’t guaranteed, the sentiment has shifted. The Fed is moving from a restrictive stance to a more supportive one for the economy.

Here are your next steps:

- Stay Informed: The economic landscape is changing. Keep up with reliable sources to see what happens next.

- Watch the Data: The Fed’s decisions are “data-dependent,” so keep an eye on the monthly inflation (CPI) and jobs reports.

- Review Your Finances: If you have high-interest debt, a rate cut could be an opportunity to tackle it. If you’re looking to buy a house, start monitoring mortgage rates.

The Fed is walking a tightrope, but for the first time in a while, it seems to have room to lean in a direction that helps your bank account.