Why Companies Are Ditching the NYSE for Nasdaq’s Tech-Forward Edge

In the grand drama of corporate life, changing your stock exchange is like breaking up publicly on Facebook and immediately posting a picture with your new, hotter partner. It’s a statement. And when a major US multinational ditches its old flame for Nasdaq’s ‘technology-forward’ approach, you know the gossip is going to be good.

This isn’t just about moving your stock ticker from one digital address to another. Let’s be real, that’s about as exciting as watching paint dry. This is a story about how even the biggest, most established companies are looking in the mirror and deciding they need a digital makeover. So grab your popcorn, because we’re about to dive into why this corporate glow-up matters for investors and the stock market.

From Men in Jackets to Servers in the Cloud: What is a “Tech-Forward” Exchange, Anyway?

For ages, the stock market meant one thing: a bunch of stressed-out people in colorful coats screaming at each other on a floor littered with paper tickets. Think Trading Places but with fewer Eddie Murphy hijinks. The New York Stock Exchange (NYSE) was the king of that beautiful chaos.

Then came Nasdaq in 1971, the nerdy younger sibling with no physical trading floor. It was born digital, a market built on electrons instead of elbow grease. And that, my friends, is the origin story of being “technology-forward.” It’s not just having computers; it’s having a whole digital DNA. For optimal SEO, this distinction is key.

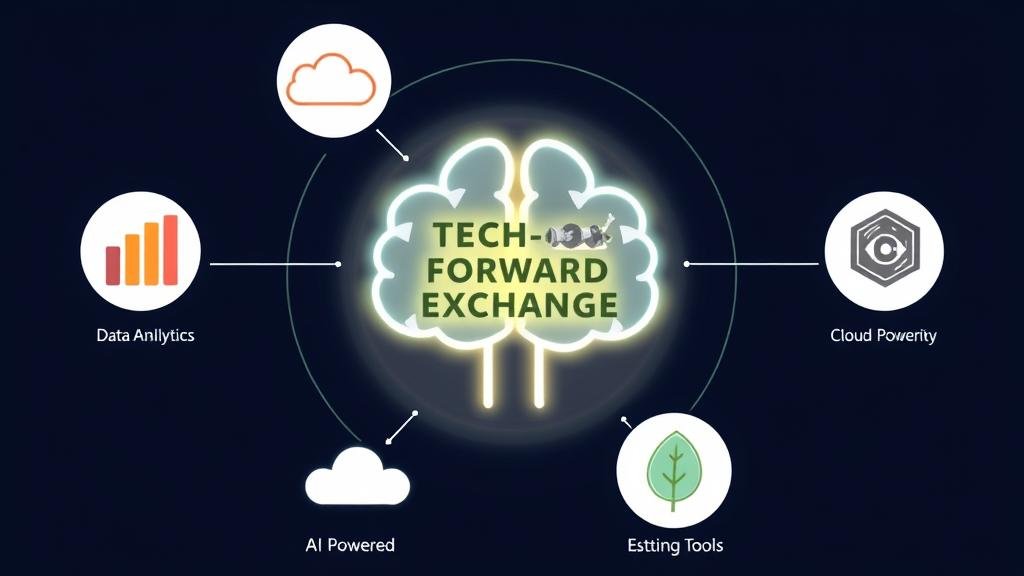

Here’s the part that’s actually kinda cool. Or maybe I’ve been doing this too long. A modern tech-forward exchange gives companies superpowers like:

- Advanced Data Analytics: Nasdaq hands its companies tools like Nasdaq IR Insight®. In human terms, it’s like corporate-level social media stalking. Companies can see who’s interested in them, what investors are gossiping about, and who they should invite to their next party (a.k.a. investor call). This is data analytics at its finest.

- Cloud-Powered Everything: By running on the cloud, Nasdaq is faster, bigger, and more reliable. It’s the difference between driving a rusty Pinto and a self-driving Tesla. Both get you there, but one is way less likely to break down during rush hour. This is a truly cloud-powered solution.

- AI-Powered Market Cops: To keep things fair, Nasdaq uses artificial intelligence to watch for shady business. Think Minority Report for stock trades. It can spot funky patterns way faster than a human chugging their third espresso. An AI-powered guardian for your trading activity.

- ESG & “Look How Good We Are” Tools: Investors today want to know if companies are, you know, not destroying the planet. A tech-forward exchange helps companies track and report all their good deeds (Environmental, Social, and Governance stuff), basically giving them a pre-written, A+ report card to show Mom and Dad Capital. This is a crucial component of modern ESG reporting.

When a corporate giant says it’s moving for this, it’s saying, “We’re not just a company that uses tech; we’re a tech company, full stop.”

The Great Migration: Why Everyone’s Moving to the Cool Kids’ Table

Let’s not kid ourselves. Packing up your stock listing and moving from a place as swanky as the NYSE to Nasdaq is a big, dramatic deal. So why are so many companies, even ones that aren’t classic tech darlings, making the leap?

*Cue dramatic pause*

1. The “Innovation Halo” Effect

Perception is everything. Listing on Nasdaq, home of Apple, Microsoft, and Amazon, is like a middle-aged company buying a fancy leather jacket. Suddenly, it looks a little edgier, a little more with it. It’s a branding move that screams, “Hey investors, we’re not old and stodgy! We know what TikTok is! (Probably!)” For a multinational, that’s a powerful way to tell the world they’re ready for the future of innovation.

2. Being the Master of Your Own Destiny (or at Least, Your Stock)

The days of just releasing a quarterly report and hoping for the best are over. Hot take coming in 3…2…1: Modern companies need to know what people are thinking about them right now. Nasdaq’s tech suite lets them do just that. It’s the difference between performing a monologue in an empty room and being a stand-up comedian who can read the audience and land the joke. For a huge company, that control is priceless.

3. It’s Just… Better? (The Boring-But-Important Part)

Now, before your eyes glaze over like a Krispy Kreme, let’s talk efficiency. Fully electronic exchanges can execute trades faster and cheaper. This generally means better prices for everyone and makes the stock easier to buy and sell (that’s “liquidity” for the folks taking notes in the back). While it’s not as sexy as a brand halo, making your stock run smoother is like getting a tune-up for your car—it just makes everything work better. And yes, this will be on the test.

What This Means for You, a Normal Human With a 401(k)

This whole thing is more than just a corporate showdown between the NYSE and Nasdaq. It’s a signal that the entire economy is shifting. Data is the new oil, and a company’s ability to use it is a giant flashing sign of whether it’ll sink or swim.

So, for you, a retail investor just trying to make sense of it all, does the stock exchange actually matter?

On a practical level, no. Buying shares of a company on the NYSE or Nasdaq feels exactly the same from your brokerage account. Your app doesn’t care.

But wait! The reason for the move is Grade-A, top-shelf information. It’s a massive tell from the company’s leadership. When they choose a “technology-forward” platform, they’re basically shouting from the rooftops that they are:

- Future-Proofing the Business: They’re not waiting for the world to change around them; they’re changing with it.

- Making Smart, Data-Driven Moves: They value intel and are using it to guide the ship.

- Speaking the Language of Modern Investors: They get that things like ESG and clear communication aren’t just buzzwords anymore.

You can look at this move as a big, fat stamp of approval from a forward-thinking management team. Still reading? Wow. You’re officially my favorite.

The Final Word: Resistance is Futile (The Robots Have Won)

The decision by a major multinational to jump ship to Nasdaq isn’t just a footnote; it’s a headline. It shows that the center of the financial universe is no longer a physical place with a fancy bell. It’s a network of data, algorithms, and cloud servers.

This isn’t to say the NYSE is going the way of the dinosaurs. It’s still a financial behemoth. But the battle is no longer about history vs. the future. It’s about who provides the most value in a world run by ones and zeros.

So as you follow the markets, keep an eye on these seemingly boring administrative changes. They’re often the tell-tale heart of a company’s strategy. In this case, the message is crystal clear: the future is digital, and the smart money is logging in. The world of trading and the stock market is evolving.