The Fed’s Dilemma: Navigating Inflation, Interest Rates, and a Cooling Job Market

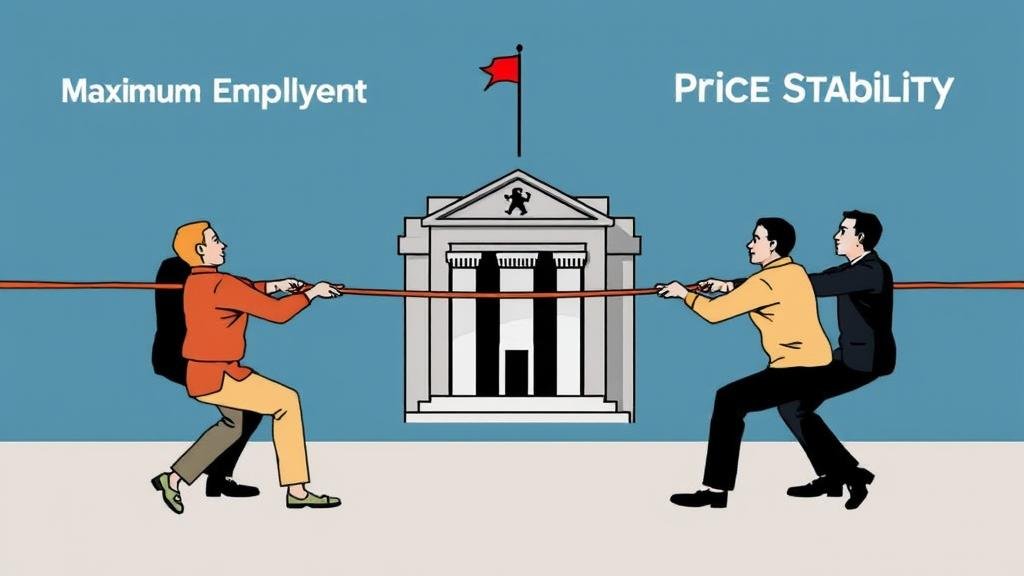

The Tug-of-War: Inflation vs. a Cooling Economy

Let’s be real, the Federal Reserve has two main jobs under its dual mandate: keep inflation from spiraling and ensure maximum employment. For the last couple of years, taming inflation has been the main event. The Fed initiated an aggressive interest rate policy, hiking rates to cool the economy and prevent runaway prices. And it has largely worked. Inflation has been trending down, which is a win for price stability.

But here’s the rub: high interest rates, the medicine for inflation, have side effects. They are designed to slow the economy, but the big question now is: did the Fed overdo it? While lingering inflation remains a concern, we’re seeing signs that the job market is beginning to weaken. This has put the Fed in a classic pickle. Do they continue fighting inflation, or do they shift focus to the wobbly job market before it signals a recession?

The Missing Piece: Delayed Economic Data

To make these critical decisions, the Fed needs official data. The most important piece is the monthly jobs report, which is the economy’s report card. It provides a clear picture of hiring trends, unemployment, and wage growth—it’s the holy grail of economic indicators.

However, a recent government shutdown has delayed the release of crucial jobs data. As The Economic Times noted, this throws a massive wrench in the Fed’s decision-making process. Without this vital information, the Fed is flying with a significant blind spot, making its next move on interest rates incredibly hard to predict.

A Divided Fed: Hawks vs. Doves

This mix of conflicting signals and missing data has led to “sharp disagreements” among Fed officials, as reported by ABC News. It’s less of a unified front and more of a heated debate. The market’s anxiety is palpable, and what once looked like a probable rate cut is now a toss-up.

There are two main camps in this financial debate:

The Hawks

This group is focused on getting inflation back down to the 2% target. They see the current rate as too high and would rather keep interest rates elevated—or even raise them again—to ensure inflation is fully contained. For them, cutting rates now would be premature.

The Doves

On the other side, the Doves are worried about the cooling job market. They see the risk of a full-blown recession if rates stay high for too long. They advocate for a rate cut now to provide a cushion for the economy before it slows down too much.

The Fed’s next decision will depend on which of these philosophies wins out.

What This Means for Your Personal Finance

Why should you care about a group of economists arguing? Because their decisions directly impact your money, from your credit score to your monthly payments.

Let’s break down what could happen to your wallet:

- If the Hawks Win (Rates stay high or rise): Borrowing will remain expensive. This means high rates for new mortgages, car loans, and credit cards. If you carry a balance, high APRs will continue to be a drain on your finances.

- If the Doves Win (Rates are cut): This would bring welcome relief for anyone with debt. A rate cut could lead to cheaper mortgages (opening up refinancing opportunities), more affordable car loans, and lower interest on variable-rate credit cards.

Given this uncertainty, the best move is to focus on financial fundamentals: pay down high-interest debt, improve your credit score to qualify for the best rates regardless, and build your emergency fund.

Looking Ahead: What to Watch For

As we await the next Fed meeting, here’s what to keep an eye on:

- Inflation Data: New reports like the Consumer Price Index (CPI) will be closely analyzed. Hot numbers strengthen the Hawks’ case; cooler numbers support the Doves.

- The Jobs Report: Whenever the official jobs report is released, it will be a major market mover. A strong report will ease recession fears, while a weak one will increase calls for a rate cut.

- Fed Speeches: Public comments from Fed officials can offer clues about their intentions.

The path forward for the economy is foggy. For now, the best strategy is to get your financial house in order and stay informed.