From Safe Bets to Moonshots: How New CEO Leadership Can Drive Shareholder Value Through Corporate Innovation

Here we go again: the corporate world’s favorite drama, the CEO Swap. As the torch is passed at another tech giant, the new leader faces a monumental task. Their primary challenge? Mastering the art of CEO leadership to convince shareholders—a group typically focused on predictable quarterly earnings—that it’s time to pivot towards bold corporate innovation to drive long-term shareholder value.

Let’s be honest, the old playbook is obsolete. For years, big tech operated on an “incremental improvement” model. Shareholders received steady, if uninspired, returns. It was the corporate equivalent of eating oatmeal for breakfast every single day: safe, reliable, and utterly boring.

But the ground is shifting. Agile startups are making disruptive leaps, threatening to leave the incrementalists behind. The “innovator’s dilemma” is no longer a business school theory; it’s a real and present danger. The new CEO’s mission is to champion strategic innovation and prove that playing it safe is now the riskiest move of all.

The End of the “Safe” Bet

The long-held strategy of not rocking the boat—a faster chip here, a slicker interface there—was profitable, but it’s a recipe for irrelevance. Startups lack the legacy systems and dividend-hungry investors that slow down large corporations. They can turn a whiteboard idea into a market-disrupting product while established players are stuck in committee meetings.

Now, let’s look at the data. A McKinsey report highlights that companies dedicating significant capital to bold ideas consistently outperform their more timid competitors. They allocate resources with the precision of a chess grandmaster, a stark contrast to the risk-averse culture prevalent in many boardrooms. This underscores the need for a fundamental shift in the corporate mindset, moving focus towards long-term value.

So, the new chief must paint a compelling picture of a future where the company is not just keeping pace but leading the charge. This requires more than a PowerPoint; it requires a complete overhaul of the corporate culture.

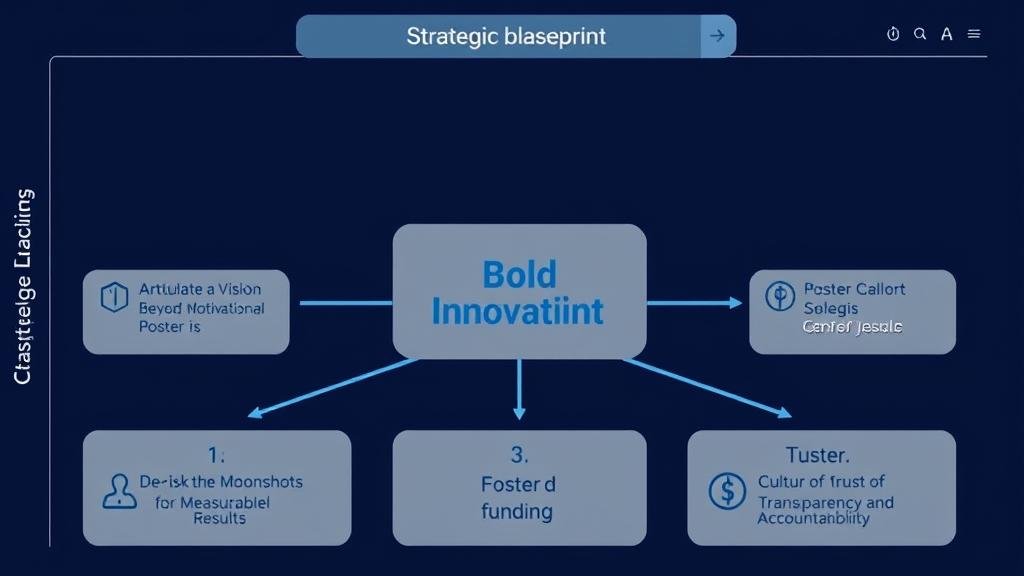

Building the Case: A Three-Step Approach to Bold Innovation

How do you persuade a room full of people who crave predictability to embrace significant, calculated risks? It requires a blend of storytelling, strategy, and radical transparency.

1. Articulate a Vision Beyond the Motivational Poster

First, the leader must present a clear, data-driven plan. This can’t be vague fluff about “synergizing innovation.” The CEO needs to answer, in plain English: “Where are we going, and why is it worth the investment?”

This is the time for a brutally honest thesis on market trends, identifying competitor weaknesses and opportunities for a knockout punch. Think of how Satya Nadella steered Microsoft into the cloud era. He had a clear vision for long-term value and repeated it until every stakeholder understood it. The new CEO must become the company’s most passionate and persistent advocate for this future.

2. De-Risk the Moonshots for Measurable Results

Shareholders get nervous; their role is to invest, not to gamble. When pitching a “moonshot,” a CEO must demonstrate that the project has a steering wheel and brakes. Achieving measurable results is key.

Here’s the strategy:

- Phased Funding: Instead of a massive upfront investment, request capital in stages. Hitting a milestone unlocks the next round of funding, turning a giant leap into a series of manageable steps.

- Strategic Partnerships: Share the risk and cost by collaborating with other companies or research institutions. This is the corporate version of asking a friend for help.

- A Portfolio of Bets: A smart company maintains a balanced portfolio. Some initiatives will be small and safe, others moderately risky, and one or two will be audacious, high-reward gambles. This ensures that a single failure doesn’t derail the entire innovation program.

This framing transforms a wild gamble into a series of calculated risks, building confidence among investors.

3. Foster a Culture of Transparency and Accountability

Trust is the foundation of this entire endeavor. A new CEO cannot simply ask for a blank check and disappear for five years. They must champion a culture of radical transparency. This means being honest about risks and providing regular updates, even when an experiment fails.

A PwC study found that 84% of investors prioritize a company’s commitment to long-term value. The most effective way to demonstrate this commitment is for the new CEO leadership to tie their own compensation to the success of these bold bets. This aligns the C-suite’s incentives, enhances team performance, and ensures everyone is rowing in the same direction.

The Road Ahead: A Call for Courage

Is this role a walk in the park? Far from it. It’s more like navigating Jurassic Park—thrilling, dangerous, and requiring speed and agility. The new CEO will inevitably face skepticism.

But in today’s rapidly evolving world, playing it safe is a death sentence. The companies that dominate the next decade will be those with the courage to invest in a future they can’t entirely predict. As we like to say, fortune favors the calculatedly bold. And we’ll be here, watching to see which leaders have what it takes to drive true corporate innovation.