The Fed’s Tightrope Walk: Navigating Inflation, Jobs, and the 2024 Housing Market

The Inflation Conundrum: Is the Beast Truly Tamed?

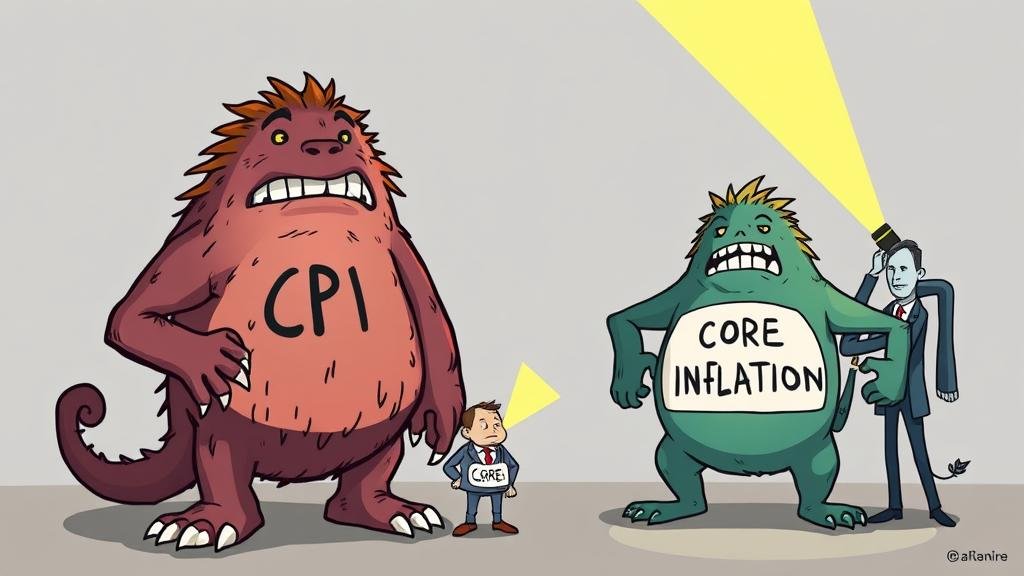

Let’s be real, inflation is the big, scary monster under the economy’s bed. For two years, the Federal Reserve has been playing the role of the brave parent, armed with the flashlight of aggressive interest rate hikes. But is the monster gone, or just pretending to be asleep? cue dramatic pause

On one hand, the big, flashy headline number (the Consumer Price Index) has been taking a chill pill, with inflation trending down from its terrifying peaks. This makes it seem like the Fed’s tough-love approach is working towards the much-discussed “soft landing.” You can almost hear a sigh of relief from Washington.

But hold on. There’s a sequel monster called “core” inflation (which kicks out the drama queens of food and energy prices). And this one is like a party guest who missed the memo that the music stopped and everyone else is cleaning up. It’s stubbornly high. The Fed watches core inflation like my dad watches the thermostat, and its refusal to budge is giving them some serious heartburn. Declaring victory now might be like celebrating the end of a horror movie when there are still ten minutes left. You feel me?

The Jobs Market: A Picture of Strength or a Sign of Weakness?

Ah, the jobs market. The thing we all complain about on Monday morning but get nervous about when it’s in the news. The latest reports are giving the Fed the economic equivalent of a “Maybe!” response to a party invitation. Thanks, that’s super helpful.

On one side of this two-faced coin, the labor market remains strong. The unemployment rate is so low it’s practically doing the limbo, and job growth has been stronger than my desire for a nap at 3 PM. This suggests the economy is a tough cookie, and maybe it can handle another rate hike without crumbling.

But flip the coin, and you’ll see the “Help Wanted” signs are getting a little dusty. The pace of hiring has slowed, and wage growth isn’t shooting for the moon anymore. Some economists are waving little red flags, worried that another rate hike could be the final Jenga block that topples the whole tower into a recession. This has Fed officials arguing like my kids over the last slice of pizza. Is the bigger risk a hot oven (inflation) or a burnt pizza (recession)?

The Housing Market: A Bellwether of the Broader Economy

Let’s talk about the one topic more stressful than a family holiday dinner: the 2024 housing market. I know, this subject isn’t exactly Netflix material, but stick with me. The Fed’s rate hikes hit this sector like a wrecking ball in a pop music video, sending mortgage rates to levels that have many reminiscing about the dial-up era, with some forecasts suggesting they could stay elevated for a while.

Naturally, home sales plummeted. Most potential buyers looked at the new mortgage payments and decided their current tiny apartment is actually quite charming. This is a clear signal the Fed’s medicine is working to cool things down.

Here’s the plot twist, though: home prices haven’t really budged. Why? Because nobody wants to sell their house and give up the golden handcuffs of a 3% mortgage rate. This has created a market with very few homes for sale, keeping prices stubbornly high. It’s like a fancy restaurant that’s totally empty, but the menu prices are still astronomical. The housing market is basically sending the Fed a text message that just says “It’s complicated.” And yes, it left them on read.

What Does This Mean for You?

Alright, you’ve waded through the economic swampland. Congrats. You’re officially my favorite. So what does this circus mean for your actual wallet?

Think of it as a “Choose Your Own Adventure” book written by people who are very, very stressed out.

If the Fed goes full-on Hulk and raises rates again, you can expect:

- Higher borrowing costs: Your credit card will start charging you interest that looks more like a phone number. Mortgages and car loans will get pricier, too.

- Better returns on savings: Your savings account, however, will finally wake up from its long nap and start paying you more than pennies. CDs will look pretty tasty.

- A cooling job market: The “Help Wanted” signs might get even dustier, which could slow down pay raises.

If the Fed decides to chill out and holds rates steady (or cuts them), the adventure goes the other way:

- Lower borrowing costs: Getting a loan might feel less like selling a kidney.

- Lower returns on savings: Your savings account will go back to offering you a return that buys you half a gumball.

- A potential boost for jobs: A less aggressive Fed could keep the job market humming along nicely.

The Bottom Line

So, what’s a Fed to do? They’re basically trying to land a 747 on an aircraft carrier in a hurricane while being heckled by economists. The truth is, the path ahead is as clear as mud. The economic outlook for 2024 is still being written.

Your job isn’t to predict the future—leave that to the fortune tellers and Wall Street analysts (often the same thing). Your job is to make sure your financial raincoat is ready, no matter which way the wind blows. Review your budget, think about your loans, and maybe give that savings account a little pep talk.

Don’t worry, we’ll be here with the popcorn and the analysis. And yes, this will be on the test. Just kidding… mostly.