The Nasdaq’s Wild Ride: What Does It Mean for Your Portfolio?

The Nasdaq Composite experienced a rollercoaster of a day, echoing the market’s mood swings. After soaring over 2%, it abruptly reversed course, erasing all gains and leaving investors with a sense of whiplash. This marked the most volatile trading day since last April, signaling that market sentiment is on precarious ground.

The day began with a surge in tech stocks, with the Nasdaq reaching new highs. This optimism was fueled by strong earnings reports and a growing belief that the Federal Reserve might pause its interest rate hikes. However, this positive sentiment was short-lived. By the afternoon, a significant sell-off dragged the index down, highlighting the fragility of the current market.

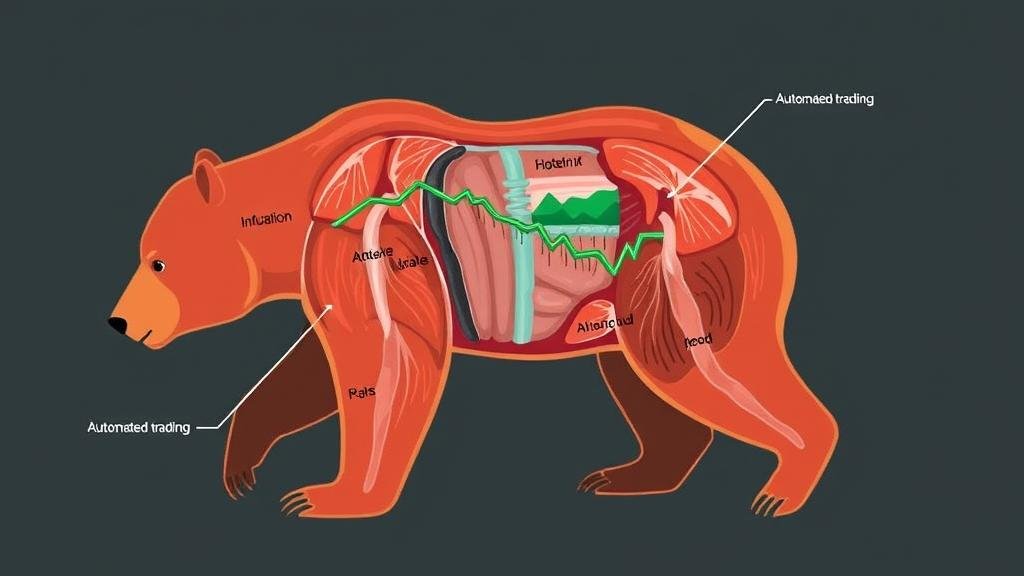

The Anatomy of a Reversal

So, what caused this dramatic turnaround? It wasn’t a single factor but a combination of them.

First, concerns about inflation continue to linger. While there are signs of cooling, the persistence of inflation raises questions about the Federal Reserve’s future interest rate policy. Higher interest rates are particularly challenging for tech stocks, as they can discount the value of future profits.

Compounding the issue were automated trading programs. As the Financial Times reported, a few large-scale sell orders triggered a cascade of automated selling, amplifying the downward momentum. The surge in trading volume, as noted by Investing.com, was a silver lining for exchanges, but a source of anxiety for investors.

Echoes of April’s Turmoil

This recent volatility is reminiscent of the market turmoil seen in April, when the Fed first signaled its aggressive stance on inflation. While the specific triggers may differ, the underlying theme of a market grappling with uncertainty remains the same. The key takeaway for investors is that the relatively calm summer period may be over.

What Does This Mean for Your Portfolio?

For many, the immediate concern is the impact on their portfolios. While it’s natural to feel uneasy during periods of market volatility, making impulsive decisions, such as selling off all your holdings, is often a mistake.

Instead, this is an opportune time to review your portfolio. Diversification is crucial to mitigating risk. If you have a long-term investment horizon, you are likely in a better position to weather this volatility. For those with a shorter timeline, it may be prudent to consider less volatile assets, such as high-quality bonds or dividend-paying stocks.

The Road Ahead

The Nasdaq’s recent performance serves as a stark reminder of the market’s inherent unpredictability. While the long-term outlook for technology remains strong, the path forward is likely to be marked by further bumps. Staying informed, disciplined, and focused on your individual financial goals is the best way to navigate this challenging environment.

In today’s market, knowledge is your best defense.