The US Plan for Ukraine that Has the EU Seeing Red

You know that feeling when you’ve been meticulously planning a group project, color-coding binders and everything, and then one team member storms in, having done a completely different project with the opposing team, and declares, “I fixed it!”?

Yeah. That’s the European Union right now. And the loud, rogue team member is the United States.

A Peace Plan with a Poison Pill?

Alright, buckle up, because this plan is a real doozy, like a plot twist from a show you thought you understood. First reported by folks who are probably still scratching their heads, the US proposal tries to end the war with a framework that has a little something for everyone to hate.

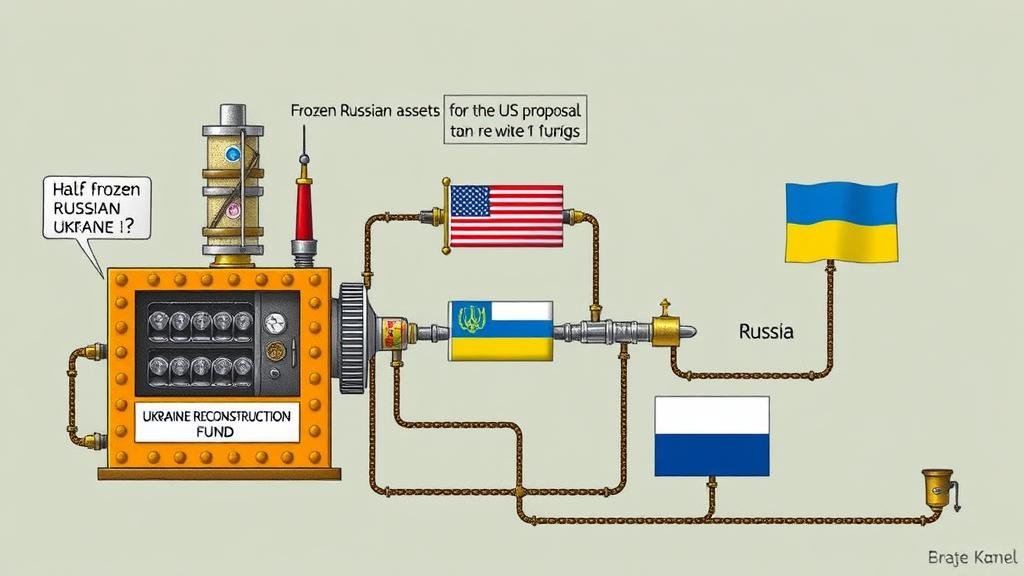

The centerpiece—the thing that’s making monocles pop all over Europe—is a joint U.S.-Russia investment fund. Let’s break this down before your eyes glaze over like a Krispy Kreme.

- Step 1: Take $100 billion of frozen Russian money. (So far, so good, right?)

- Step 2: The U.S. manages it to invest in Ukraine’s reconstruction. (Still with me? Seems noble.)

- Step 3: The United States keeps 50% of the profits. (Record scratch. Wait, what?)

- Step 4: The other 50% of profits get split between Russia and Ukraine.

On the surface, it’s… creative? But the strings attached have more knots than my headphones after five minutes in my pocket. For Ukraine, it allegedly means confirming sovereignty but also kissing its NATO dreams goodbye. For Russia, it’s the indignity of watching its arch-nemesis manage its money and skim off the top. It’s like grounding your kid, taking their allowance, investing it, and then giving them a fraction of the profits while you pocket the rest. My 7-year-old would call that “super not fair.”

So, to recap: Kyiv and Moscow are forced into a partnership run by Washington. What could possibly go wrong?

The EU’s Fury: “A Torpedo to Our Plans”

While Kyiv and Moscow are weighing this deal like it’s a moldy piece of cheese, the real bonfire of rage is burning in Brussels. See, the EU holds most of Russia’s frozen assets—we’re talking over €200 billion—and they had their own plan. A very sensible, very European, by-the-book plan.

The EU was going to use the interest from the assets to help Ukraine. Think of it as using the dividends from your 401(k) to buy a fancy coffee, not raiding the whole fund to buy a yacht. It was cautious, legally sound, and painstakingly slow. In other words, peak European bureaucracy.

The US plan, by contrast, is seen as a reckless cash grab. An unnamed EU official, probably while stress-eating a waffle, called it a “torpedo” to their plans. Let’s be real, you don’t use the word “torpedo” unless you’re seriously ticked off. The feeling is that after months of holding hands and singing “Kumbaya” against Russia, the US just scribbled its own plan on a napkin in the middle of the night.

The lack of a heads-up is what really stings. It’s the geopolitical equivalent of finding out your partner put a down payment on a house in another state via a Facebook post. Ouch.

Geopolitical Fallout and the Future of the West

Okay, let’s put on our serious-person glasses for a moment. Cue dramatic pause. The ripple effects here are huge.

- For the Transatlantic Alliance: The trust between the US and EU has been more damaged than my dignity after a karaoke night. This whole thing pours gasoline on the fire for leaders who’ve been saying Europe needs to become its own superhero and stop relying on Captain America.

- For Ukraine: This is deeply unsettling. It’s like being rescued from a burning building, but the firefighter keeps trying to sell you a timeshare on the way out. Forcing a “non-aligned” status on them feels like a gut punch to a country that has sacrificed everything for a European future.

- For Russia: The Kremlin is probably eating popcorn and watching this whole thing like it’s the season finale of their favorite reality show, The West Implodes. A divided alliance is the #1 item on Putin’s wish list.

And this, my friends, is why we can’t have nice things. Or, you know, a coordinated foreign policy.

Hot Take Incoming: This Is a Financial Face-Palm

Here’s the part that’s actually kinda scary. Just kidding—it’s all scary. But this part makes money people nervous.

The entire global financial system runs on a gentleman’s agreement called “sovereign immunity,” which is a fancy way of saying “countries don’t (usually) steal other countries’ official money.” This US plan takes that rulebook, tears it up, and makes confetti.

If the world’s biggest economy can just seize another country’s reserves and turn them into a hedge fund where it keeps half the profits, other nations might start thinking the US dollar is not such a safe bet anymore. They might start stashing their rainy-day funds elsewhere. You feel me? It’s a move that could mess with the financial system in ways that are… not fun.

Still reading? Wow. You’re officially my favorite.

An Uncertain Path Forward

This whole surprise party of a plan has thrown a wrench into the gears of Western unity and Ukraine’s future. In the noble quest for peace, the US seems to have chosen a path that prioritizes its own wallet and alienates its closest friends.

Will the EU cave? Will it push back and start a full-blown transatlantic squabble? And where does this leave Ukraine, stuck in the middle of a tug-of-war between the two giants who are supposed to be on its side?

One thing is for certain: the path to peace was already complicated. America just decided to add a few banana peels and a rogue unicycle. And yes, this will be on the test.