UK’s 38% Tax Squeeze: Your Personal Finance Guide for 2024/25

Ever get that feeling your wallet is on a diet you didn’t approve of? Well, you’re not wrong. A financial storm is brewing over the UK, and with the new financial year 2024/2025, it’s about to make our bank accounts feel like they’ve been through the spin cycle. The forecast? The nation’s tax burden is set to hit a staggering 38% of Gross Domestic Product (GDP).

Now, before your eyes glaze over, let’s translate. That means for every £100 of value this country produces, the government plans to swipe £38. That’s not just a statistic; it’s the reason your next pay rise might feel less like a “woohoo!” and more like an “oh… right.”

This is your essential UK personal tax guide for 2024/25, breaking down what this all means for you, me, and the squirrel in the garden who’s probably hoarding nuts more successfully than we’re hoarding cash.

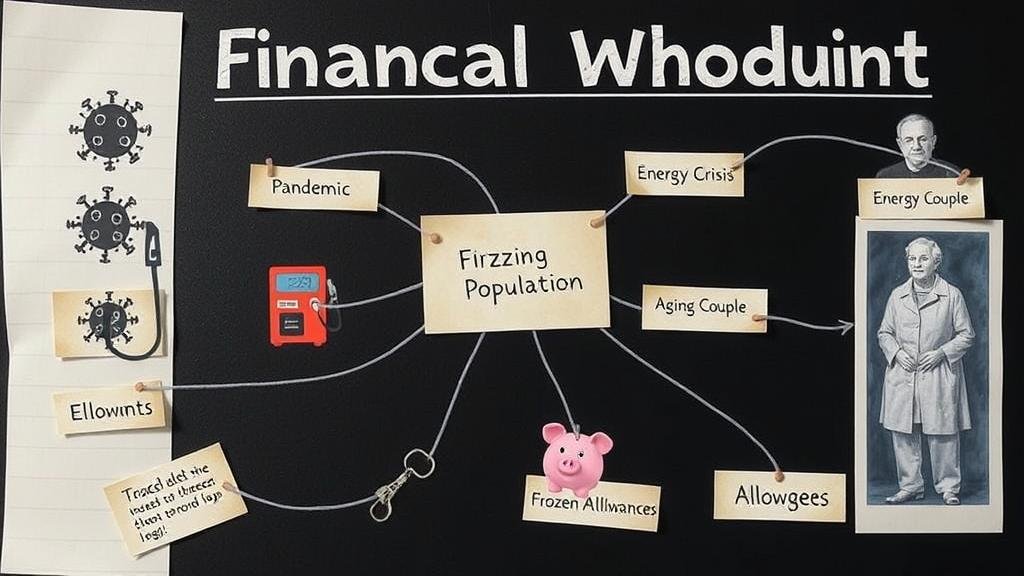

The Unprecedented Climb: A Financial Whodunit

For decades, the UK’s tax bill has gone up and down. But this time, it’s climbing faster than a cat up a curtain, rocketing up from an average of 33% in the early 2000s to this new, dizzying height.

So, who’s the culprit? It’s more of a team effort, with the bill from the Spring Budget 2024 and other pressures coming due. The lineup of suspects includes:

- The Pandemic Hangover: Propping up an entire country during a global plague costs a lot of money. The bill is now due, and the government is holding a bake sale where we all have to buy a cake.

- Global Drama: The war in Ukraine and the wild energy crisis that followed meant more emergency government spending. Another massive IOU for the public purse.

- The Grand-Pop-ulation: The UK is getting older. More grandparents mean more demand for health and social care, and that, my friend, ain’t cheap.

- The Sneakiest Tax Change of All: Here’s the infuriatingly clever part. Freezing the personal allowance for 2024/25 at £12,570 is the government’s favourite magic trick. As your wages go up with inflation, you get shoved into a higher tax bracket. It’s called “fiscal drag,” which sounds like a boring accounting term but is actually the government picking your pocket while you’re distracted.

The Office for Budget Responsibility basically confirmed it: the taxman is coming, and he’s planning to stay for a while.

What Do the 2024/25 Tax Changes Mean for Your Wallet?

This isn’t just a headline—it’s a direct hit to your everyday life.

The Squeeze on Your “Fun Money”

The most obvious effect? Less money for, you know, living.

- Income Tax & National Insurance: Thanks to fiscal drag, that shiny new pay rise you negotiated might barely cover your extra tax. The cut to the main rate of Class 4 National Insurance to 6% helps the self-employed, but for many, the squeeze is real.

- Council Tax: Your local council is also feeling the pinch, which means your council tax is probably going up. It’s like a subscription service you can’t cancel.

The Chill on Your Savings and Investments

Trying to build a nest egg? A higher tax burden can feel like trying to build a sandcastle as the tide comes in. Effective tax planning is more crucial than ever.

- Capital Gains Tax (CGT): Sold some shares that did well? Awesome! The government would now like a larger chunk of that profit. The tax-free allowance has been shrunk, so more of your win goes to them.

- Dividend Tax: If you own stocks that pay you dividends, the tax-free amount on that has also been slashed. It’s a direct hit on anyone trying to move from income to ISAs and other investments.

Punishing people for saving and investing isn’t exactly a great way to encourage, well, saving and investing.

A Balancing Act: The Government’s Dilemma

From the government’s chair, this is a necessary evil. If they don’t raise taxes, they have to cut public services. The extra tax cash is meant for:

- The NHS: Our beloved National Health Service needs a colossal amount of money to clear backlogs and keep us all ticking.

- Social Care: We desperately need a better system for looking after our elderly and vulnerable.

- Education: Investing in schools is vital if we want future generations to figure a way out of this mess.

It’s a classic rock-and-a-hard-place scenario. Either way, someone’s unhappy.

Navigating the High-Tax Landscape: Your Tax Planning Strategy

While you can’t make your tax bill disappear, you’re not powerless. It’s time to put on your financial superhero cape.

- Maximise Your Tax-Free Shields (ISAs): ISAs are your best friend. Any money you make from interest or investments is 100% tax-free. Use your annual allowance. It’s a no-brainer.

- Power Up Your Pension: This is the ultimate tax-busting move. When you put money into your pension, the government gives you tax relief. It’s basically free money to reward you for saving.

- Call in a Pro: A good financial advisor is like having a guide through the perilous UK tax system. They can help you structure your finances to be as efficient as possible.

The Road Ahead: A New Fiscal Reality?

Are we doomed to a life of eating own-brand beans? Probably not. But this journey to a 38% tax burden isn’t a temporary blip; it’s the new normal.

We’re adjusting to a reality where the state is a bigger part of our lives, paid for by a bigger chunk of our money. The key takeaway is this: the burden is rising, but being informed and smart about your finances is your best line of defense. And yes, this will be on the test of life.