Bank of England Probes $2 Trillion Private Credit Market for Systemic Risk

The Bank of England is making some important calls to major players in American finance, including heavyweights like Blackstone, Apollo, and KKR. This isn’t just a friendly chat; it’s a crucial review of the private credit market, a booming $2 trillion industry. When a central bank starts talking about systemic risk, it’s a clear signal to pay attention.

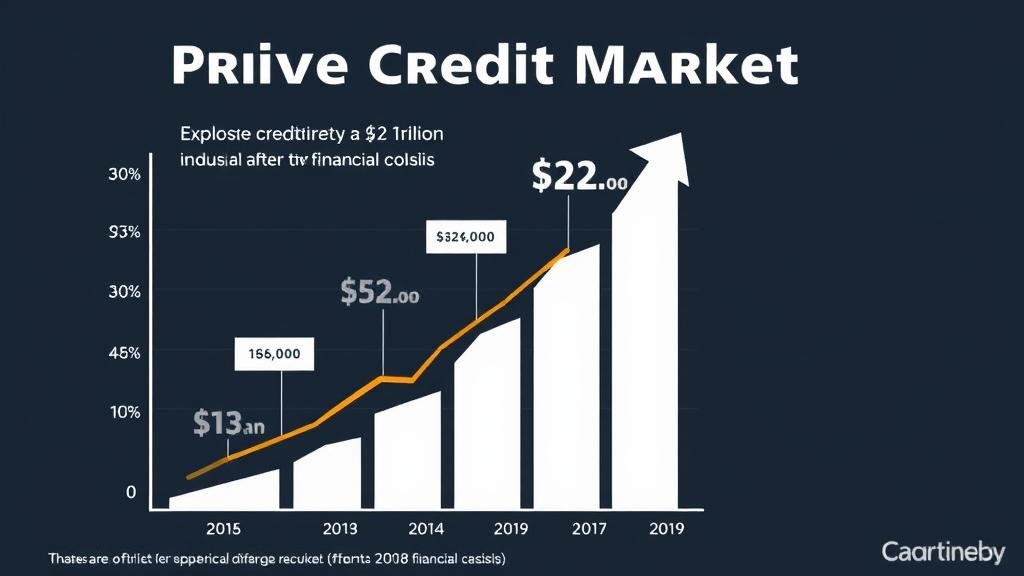

The Meteoric Rise of Private Credit

To understand the Bank of England’s concern, you need to know what private credit is. After the 2008 financial crisis, traditional banks faced heavy regulations, making them hesitant to lend. This created a gap in the market.

Enter private credit funds. These firms, backed by capital from pension funds and insurers, stepped in to provide flexible, quick loans to businesses. This shadow banking system fueled a massive boom, growing the private credit market to over $2 trillion. While it spurred economic growth, its rapid, unregulated expansion is now a key focus for maintaining financial stability.

Why are Regulators Concerned?

The very features that made private credit so successful are now sources of worry for regulators like the Bank of England. The main concerns boil down to a few key points regarding risks in the private credit market.

1. Lack of Transparency

Private credit deals are notoriously opaque. The terms, interest rates, and loan ownership are not publicly disclosed. This lack of transparency makes it difficult for regulators to assess the full picture of risk, meaning a hidden weakness could be building within the financial system.

2. Deep Interconnections

The private credit market is deeply woven into the global financial system. Pension funds and insurance companies are major investors. A wave of defaults on these private loans could trigger significant losses for these institutional investors, creating a domino effect that poses a systemic risk to the broader economy. This interconnectedness is a primary focus of the Bank of England private credit review.

3. The Illiquidity Problem

Assets in private credit are considered illiquid, meaning they can’t be easily sold. Valuing these assets is also subjective, often left to the fund managers themselves. In a financial downturn, a rush to sell could lead to a fire sale, causing asset values to plummet and amplifying the crisis. This liquidity risk in private credit is a significant concern.

The Bank of England’s Financial Stress Test

In response to these risks, the Bank of England has initiated a “system-wide exploratory scenario”—essentially a massive stress test. They are asking major private credit firms to model how their loan portfolios would perform in a severe economic downturn. The BoE stress test on private credit aims to uncover:

- The potential scale of financial losses.

- The likelihood of a mass panic and investor rush for the exit.

- How the fallout could impact the wider financial system.

The participation of major US firms signifies that the industry acknowledges the era of minimal oversight is ending and that private credit regulation is on the horizon.

What This Means for the Future

This regulatory review is a sign that the private credit market is maturing. It’s no longer an “alternative” investment but a cornerstone of modern finance.

- For Private Credit Firms: Expect increased demand for transparency and reporting. While this means more paperwork, it also introduces a layer of stability that benefits the industry long-term.

- For Investors: Greater oversight and a more stable system are good news for the pension funds and institutional capital invested in this space.

- For Everyone: A stable financial system is crucial for economic health. The Bank of England’s proactive approach to identifying and mitigating potential crises is a responsible step toward ensuring financial stability.

Ultimately, the Bank of England’s probe into this colossal market is a necessary move. As private credit solidifies its role as a systemically important part of the financial landscape, it must embrace greater responsibility and regulation.