The 2024 Cost of Living Squeeze: A Survival Guide

Ever feel like your budget is part of a magic act? One moment your grocery money is there, and the next, poof! It’s vanished. If you feel like the rising cost of living has launched into the stratosphere without you, you’re not alone. This isn’t about cutting back on luxuries anymore; for many, the current economic climate is forcing a hard look at needs versus wants. While economists anxiously watch consumer spending habits, the momentum is slowing. After all, it’s tough to stimulate the economy when a bag of chips costs what a movie ticket did in 2005.

What’s a “Consumer Unit” and Why Should I Care?

Economists use the term “consumer unit” to describe a household of any kind—families, couples, or even roommates who pool their incomes. When costs for this unit rise, it triggers a domino effect that impacts everyone’s personal finance. While we keep hearing that inflation is “easing,” it doesn’t feel that way at the checkout counter. This slow, steady squeeze on your wallet can feel like a boa constrictor hug that never ends.

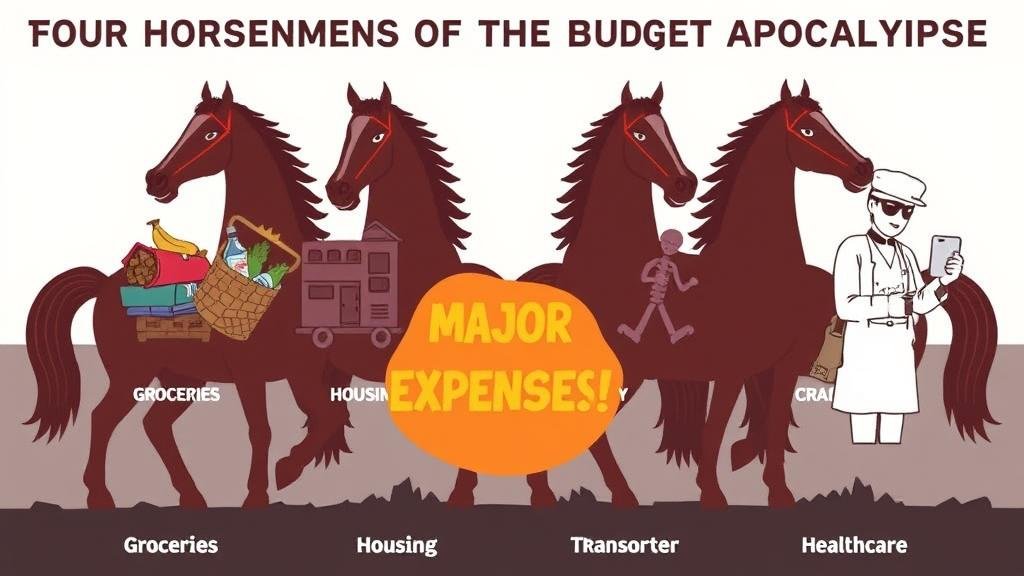

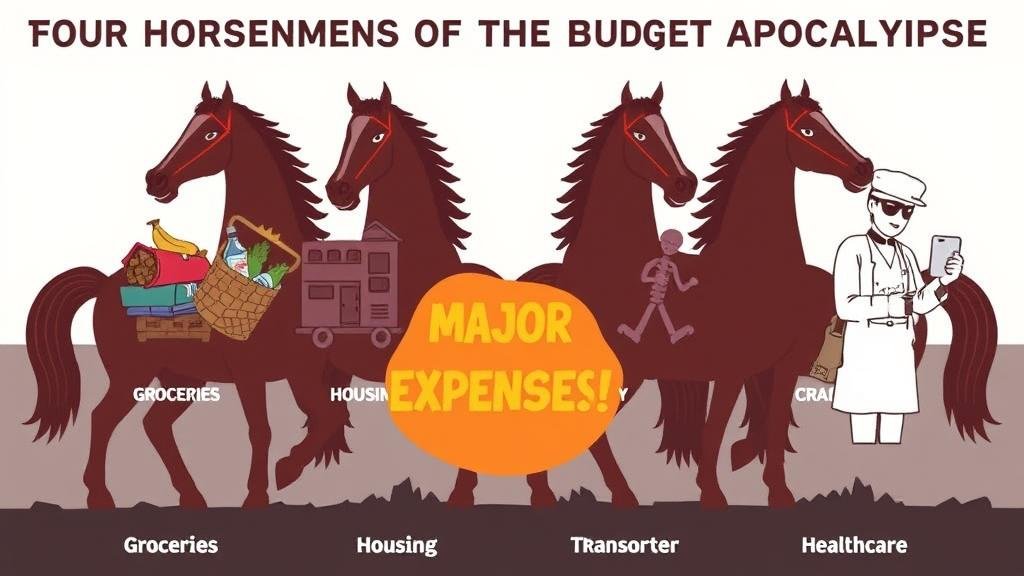

The Four Horsemen of Your Budget Apocalypse

The rising prices aren’t the work of a single villain but a whole crew of them. Here are the key players making the most significant dent in your budget:

- Ever-Climbing Grocery Prices: The grocery store has become a battleground. The price of staples like eggs, bread, and milk has skyrocketed, making you question every purchase. It’s a daily game of financial Tetris, and the blocks are falling faster than ever.

- The Housing Burden: For most, housing costs are the largest expense. Rent prices have soared, and high home prices and mortgage rates have made homeownership feel like an exclusive club. The dream of a white picket fence has been replaced with the reality of a studio apartment with a view of a chain-link fence.

- Sticker Shock at the Pump: The volatility of transportation costs makes it nearly impossible to budget. Gas prices, car insurance, and maintenance have all joined the party, making it more expensive to get around. Even if you don’t drive, you still pay the price when businesses pass on higher shipping costs to you.

- The High Price of Health: Healthcare costs, including premiums, deductibles, and co-pays, have been on the rise for years. A single trip to the ER can be financially devastating, leaving you with confusing bills for months.

How to Fight Back (Besides a Little Crying)

Faced with this financial smackdown, people are getting creative. Staycations are replacing lavish vacations, and home-cooking is the new dining out. We’re all becoming experts at saving money, hunting for deals, and clipping coupons. Budgeting, once a chore, is now a crucial survival skill. The mental toll is real, but taking control of your finances can make a world of difference.

A Practical Action Plan

It’s time for some actionable advice. Here are a few steps to help you navigate the chaos:

- Create a Detailed Budget: If your current budget is just hoping for the best, it’s time for an upgrade. Track your spending for a month to see where your money is going. This is the first step in effective financial planning.

- Prioritize Your Spending: Cover your needs first: housing, food, transportation, and healthcare. Then, you can decide what’s left for wants. This might mean cutting back on a few streaming services.

- Build an Emergency Fund: Your emergency fund is your financial safety net. Aim for three to six months of expenses. Start small—every dollar counts.

- Use Credit Wisely: Credit cards can be useful tools, but they’re dangerous if misused. Pay your balance in full each month to avoid high interest rates and the stress of managing debt.

A Final Word

This economic climate is challenging, but being informed and proactive puts you in control. By making smart choices and engaging in solid financial planning, you can weather this storm and come out stronger. You’ve got this.