AI Stock Market Correction: Did the AI Bubble Just Burst?

The stock market, after a year-long sprint fueled by AI enthusiasm, finally hit a wall. The tech-heavy Nasdaq and S&P 500, which had been enjoying an incredible bull run, faced a sharp downturn as the optimism around artificial intelligence stocks began to wane. So, is the AI party officially over?

For months, the market’s growth was dominated by a few tech giants. Companies like Nvidia, a leader in the AI chip sector, saw their stock prices soar, creating a sense of unease about a potential AI bubble. While fantastic for portfolios, the rapid rise in tech stocks felt unsustainable, leaving investors wondering when the correction would come.

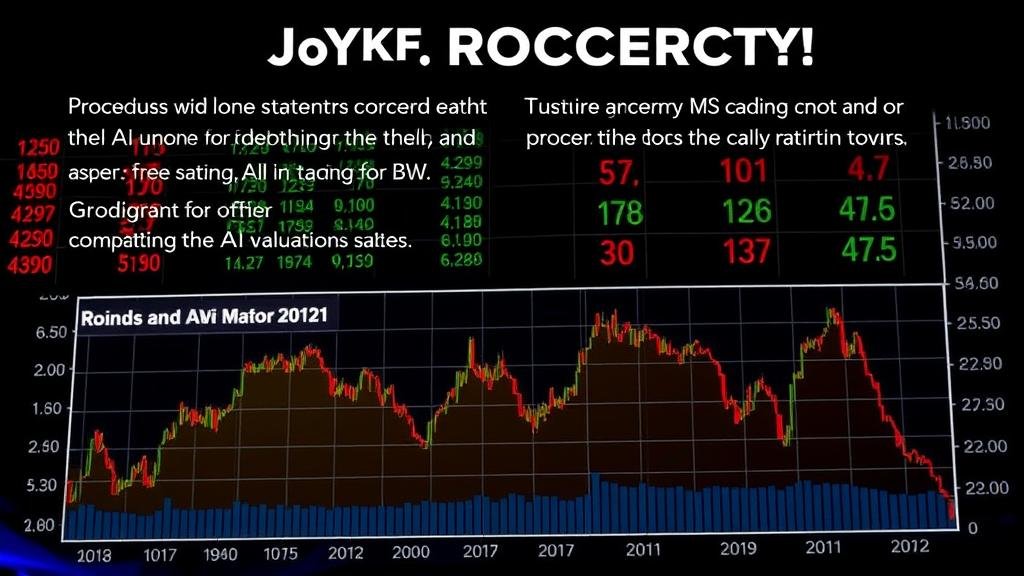

Thursday was the day the music stopped. Despite stellar earnings from Nvidia that initially suggested the rally would continue, a wave of selling pressure triggered a broad market retreat. This sudden shift highlighted the growing concerns over “stretched AI valuations.” Investors are now questioning whether the sky-high prices of AI stocks are justified by their future earning potential. The market is beginning to scrutinize the long-term value behind the hype.

Adding to the market volatility, a surprisingly strong jobs report has made it less likely for the Federal Reserve to cut interest rates. The prospect of “higher for longer” rates—a major headwind for the stock market—spooked investors, prompting many to cash in on their AI-driven gains. One analyst noted that the dip in Nvidia’s stock “fueled a reversal in AI valuations,” demonstrating how the entire market can be affected when a leading player falters.

Is this the End of the AI-Powered Bull Run?

This recent downturn is likely less of a catastrophic bubble burst and more of a necessary stock market correction. The market needed a breather after its prolonged rally. It’s crucial to remember that a temporary dip in stock prices doesn’t diminish the long-term potential of AI. As Morningstar stated, “There’s no turning back on AI now.” The technology is still poised to revolutionize industries, which remains a bullish sign for long-term investing.

Your Guide to Navigating Market Volatility

So, what should the average investor do now? Navigating these market trends can be tricky, but here’s a simple guide to help you make smarter investing decisions:

- Diversification is Key: This market correction serves as a powerful reminder to diversify your portfolio. Avoid concentrating all your investments in a single sector, even one as promising as AI. A diversified portfolio is essential for effective portfolio management.

- Adopt a Long-Term Perspective: Trying to time the market is often a losing game. Focus on your long-term financial goals. Long-term investing consistently rewards patient investors who can ride out short-term fluctuations.

- Avoid Panic-Selling: Selling your stocks during a downturn locks in your losses and means you could miss out on the eventual recovery. Resisting the urge to panic-sell is a cornerstone of a sound investing strategy.

- Assess Your Risk Tolerance: Use this period of stock market volatility to evaluate your comfort level with risk. If this dip caused you significant stress, you might consider adjusting your portfolio to a more conservative allocation.

The Road Ahead: A New Chapter for AI Investing

The coming weeks will likely bring more uncertainty as the market finds its footing. However, the fundamental story of AI remains intact. The initial fever may have broken, but the technology’s long-term potential is undeniable. For investors who remain patient and disciplined, this stock market correction could represent the beginning of a smarter, more sustainable chapter in the AI growth story.