The AI Stock Market Correction: Is the Party Over, or Is This a Buying Opportunity?

For over a year, the AI stock party has been raging. The music was loud, the punch was spiked with Nvidia chips, and it seemed like everyone was getting rich. But on Thursday, someone abruptly flipped on the lights, turned off the music, and announced the party was… well, taking a very awkward break. Wall Street felt the jolt, and not the fun, “I just had my third espresso” kind of jolt. The Nasdaq and S&P 500 both took a tumble as a wave of fear, a classic sign of market volatility, washed over investors.

The weird part? There was no obvious villain. No corporate scandal, no system-wide crash. It was more like that quiet, creeping feeling you get when you realize you’ve been flying down the highway for an hour and haven’t seen a single cop. Is this too good to be true?

The very excitement that shot the market into the stratosphere has become the source of its anxiety. Even another mind-blowing earnings report from AI kingpin Nvidia wasn’t enough to keep the good times rolling. This sudden plot twist has everyone asking: was that the peak? Are we in for a dip—a real AI stock market correction—or is this the big one your financially anxious uncle (hi, that’s me) has been muttering about? Let’s dive in.

The Unstoppable Rally Meets a Very Red Light

To understand why Thursday felt like a cold shower, you have to appreciate just how wild the party was. Let’s be real, the past year has been a masterclass in FOMO (Fear Of Missing Out). Ever since ChatGPT burst onto the scene in late 2022 and started writing better poetry than most high schoolers, investors have been throwing cash at anything with “.ai” in the name like it was the last roll of toilet paper in 2020.

This wasn’t just vibes; there were receipts. Nvidia, the company making the silicon brains behind the whole operation, saw its revenue and stock price do things that should be illegal outside of a video game. Its success became the ultimate barometer: if Nvidia was crushing it, the AI universe must be healthy.

But a rally that fast and that furious will inevitably lead to questions. You know, uncomfortable ones, like, “Are we sure this is sustainable?” Stock prices are supposed to reflect a company’s actual value. When they detach from that and start running on pure, uncut hype, you get what the fancy folks call a “valuation bubble.” Or, as I call it, the “Uh-Oh Zone.” And on Thursday, Wall Street officially entered the Uh-Oh Zone.

Deconstructing the Fear: Why Now?

It wasn’t just one thing that caused the sell-off. It was more like a whole pot of anxiety stew finally bubbling over.

1. Valuation Vertigo

The main ingredient in our stew? Good old-fashioned sticker shock. AI stocks have become ridiculously expensive compared to what they actually earn. As NBC News pointed out, the initial euphoria gave way to a stark reality check. Cue dramatic pause. Even with insane growth, are these companies really worth these astronomical prices?

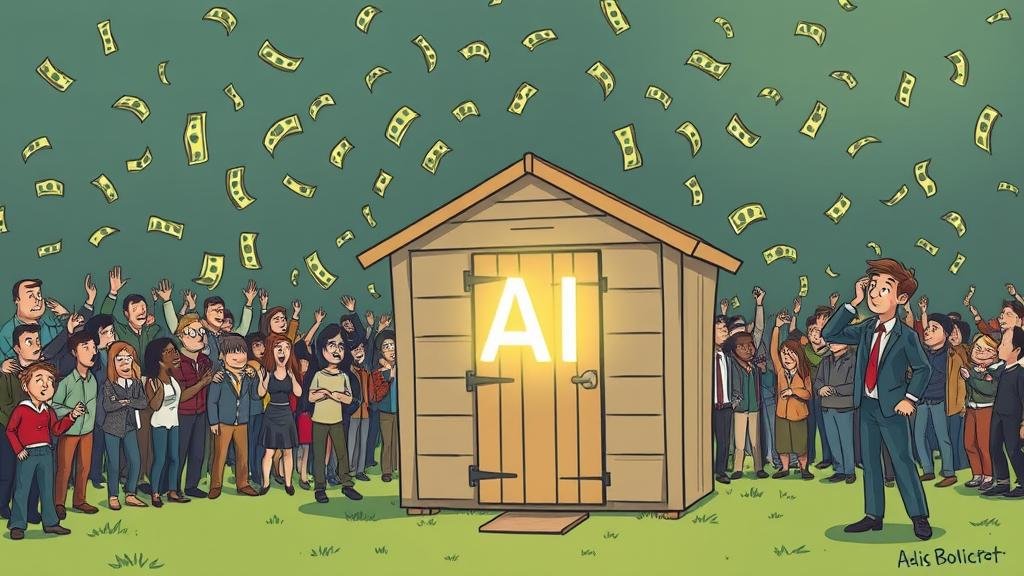

Think of it like this: You see a garden shed for sale for a million dollars. Why? Because it’s in a hot neighborhood and someone painted “Smart Shed” on the door. For a while, people keep bidding it up. But eventually, someone stops and says, “Wait… it’s still a shed.” That’s the feeling Wall Street got this week. The fear is that stock prices haven’t just priced in next year’s growth, but the next decade’s… and maybe their hypothetical kids’ success, too.

2. Profit-Taking: Cashing In the Chips

Look, if you bought a lottery ticket and it hit for a million bucks, would you just frame it and hang it on your wall? No! You’d cash it in before you accidentally lost it in the laundry. That’s profit-taking. Many investors who hopped on the AI train early have seen their portfolios swell to glorious, unbelievable sizes. This week, a bunch of them decided it was time to lock in those gains.

This is a totally normal market cycle. It doesn’t mean the party’s over forever, but when a big wave of selling starts, it can trigger automated sell orders and create a domino effect. It’s less a vote of no confidence in the future and more a vote of confidence in paying for a nice vacation right now.

3. The Shadow of Interest Rates

Now, before your eyes glaze over like a Krispy Kreme, let’s talk about the Fed. For months, the market was basically a 7-year-old waiting for its allowance (interest rate cuts from the Federal Reserve). The idea was that lower rates would make it cheaper for companies to grow.

But recent economic data has been surprisingly strong, which has led to fears that Mom and Dad (the Fed) might keep that allowance on hold for a while. As hopes for rate cuts fade, boring-but-safe investments like government bonds start looking pretty good. When you can get a decent return from something safe, the urge to gamble on high-flying, super-expensive tech stocks gets a little weaker. You feel me?

What This Means for You: A Perspective from Your Favorite Uncle-slash-Writer

Okay, deep breaths. Seeing your portfolio go red feels like getting a bad report card you have to show your parents. It’s unnerving. But panic is a terrible financial advisor. A downturn isn’t a reason to run for the hills; it’s a reason to have a plan.

- Embrace the Long-Term View: Market volatility is basically the cover charge for getting into the stock market club. The AI revolution isn’t a fad like, say, my brief obsession with making sourdough bread in 2020. It’s a real, world-changing shift. One bad day doesn’t change that.

- Diversification Is Your Shield: This is the “Don’t Put All Your Eggs in One AI-Powered Basket” part of the lecture. The slump is a beautiful, painful reminder of why. If your portfolio was 90% high-flying tech stocks, you probably felt this drop in your soul. A spread-out portfolio (diversification) can soften the blow.

- A Correction Can Be a Buying Opportunity: Hot take coming in 3…2…1: A sale is a sale. For long-term investors, a market dip can bring those inflated prices back to Earth, offering a chance to buy into great companies at a less-insane price. This could be a solid buying opportunity. The key is to focus on quality companies, not just the hype train.

Class dismissed. And yes, diversification will be on the test.

The Future of AI: From Hype to Sustainable Growth

So, is the AI dream dead? Nah. It’s just growing up. The initial phase—driven by pure, unadulterated excitement—seems to be ending. The market is like a teenager moving out of the “wild party” phase and into the “okay, I actually need a job and a budget” phase.

Investors are going to start demanding more than just a good story. They’ll want to see profits, sustainable growth, and a clear plan. The market is starting the messy but necessary job of figuring out what these world-changing technologies are really worth.

The coming months will probably be as rocky as a Marvel movie’s third act, but this shift is ultimately a good thing. It’s a reminder that fundamentals matter. The age of AI is here to stay. The age of getting rich quick just because a company name sounds futuristic? That might be over. And honestly, that’s probably for the best. 📉