The End of an Era: What the Bank of Japan’s Policy Shift Means for Global Markets

The global financial market, a notoriously anxious beast, just did the last thing anyone expected. It relaxed.

In a move that should have sent tremors worldwide, the governor of the Bank of Japan (BOJ) signaled a potential end to their decade-long negative interest rate policy. This is the monetary equivalent of canceling a teenager’s unlimited credit card. You’d brace for a full-blown tantrum.

Instead, the market’s reaction was surprisingly serene. A day after the announcement, the Japanese yen is stable, and stocks haven’t taken a nosedive.

What’s going on? Did the market collectively start a meditation retreat, or is there a more calculated play at hand? Let’s be real—it’s the latter.

What Did the BOJ Governor Actually Signal?

For years, the Bank of Japan has been the global economy’s most generous benefactor, holding interest rates in negative territory. This policy, part of a broader strategy of unconventional monetary policy including quantitative easing (QE) and yield curve control (YCC), was designed to push money into the economy rather than letting it stagnate in banks.

But BOJ Governor Ueda hinted that the party might be winding down, stating that the situation would become “even more challenging” from the year’s end. In the coded language of central banking, that’s a loudspeaker announcement that a rate hike is on the table.

This is what experts call a “hawkish pivot”—a shift toward tighter monetary policy. It signals that the BOJ believes Japan’s economy is robust enough to handle higher borrowing costs, likely because inflation is finally stirring after a long slumber. This is a monumental shift.

The Yen Wakes Up

The one corner of the market that reacted as predicted was the Japanese yen. After years of being the underdog in the currency world, it started showing signs of life.

The USD/JPY pair—a measure of how many yen a single dollar can buy—promptly fell. This is because, for years, investors have profited from the “carry trade”: borrowing yen at near-zero cost, selling it, and investing in higher-yield assets like U.S. bonds. This constant selling kept the yen’s value suppressed.

Ueda’s comments served as a warning that this free ride might be ending. If Japan offers positive interest rates, the yen becomes a more attractive asset to hold, not just to borrow. Increased demand translates to a stronger yen. It’s that simple.

Why Did Stocks Remain Unfazed?

Here’s where the plot thickens. Typically, the mere mention of “higher interest rates” sends the stock market into a tailspin, as it becomes more expensive for companies to borrow and invest.

Yet, Japan’s Nikkei 225 index barely budged. No panic, no sell-off. What explains this strange calm?

- It’s a Vote of Confidence: Investors are interpreting this not as a threat, but as a sign of strength. A central bank only tightens its policy when it believes the economy is on solid ground. After decades of fighting deflation, this signals a return to health, with potential for real wage growth and consumer spending.

- No Surprises Here: Astute market watchers knew the BOJ’s ultra-loose policy couldn’t last forever. The bank has been telegraphing this move for over a year by subtly adjusting its yield curve control (YCC) to allow bond yields to rise. This slow, deliberate communication prevented a market shock.

- Bond Market Stability: An auction of Japanese Government Bonds (JGBs) saw strong demand *after* the announcement. If investors were genuinely worried, they would be selling these bonds. Their continued buying shows confidence in the market’s stability, preventing a wider wobble.

What Does This Mean for You?

The end of Japan’s unique monetary era has global implications.

- For Forex Traders: The days of easy short bets against the yen are likely numbered. Expect increased volatility as the yen reasserts itself.

- For Equity Investors: A stronger yen is a mixed bag for Japanese stocks. It could hurt major exporters like Toyota but may benefit banks, which can earn more from lending at higher rates.

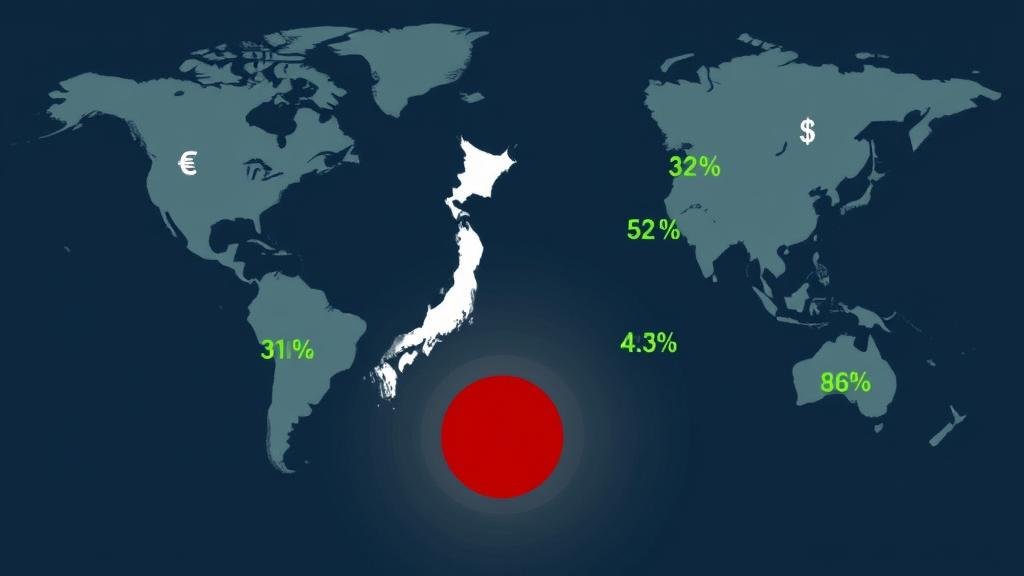

- For Global Markets: For years, Japan has been a massive source of global investment capital. If higher domestic rates incentivize Japanese investors to bring their money home, it could create ripples everywhere, potentially raising borrowing costs for everyone.

What to Watch For

The BOJ is famously cautious. A rate hike isn’t a certainty, and if it happens, it will be small. The bank will be closely monitoring several key indicators:

- Inflation: Is it sustainable and driven by domestic demand?

- Wage Growth: Are pay raises becoming a consistent feature of the economy? This is critical.

- Global Economic Health: A downturn in the US or Europe would likely put the BOJ’s plans on hold.

The market’s calm response suggests it is focused on the long-term prize: a healthier, more normalized Japanese economy. This isn’t a moment for panic, but for careful observation as the final chapter of the post-2008 cheap money era draws to a close.