The Day a Broken A/C Froze the Global Financial Markets

You know that primal wave of panic when your A/C dies in the middle of a heatwave? That sticky, existential dread as you realize your home is about to become a sauna?

Now, imagine that, but instead of you sweating through your favorite t-shirt, it’s the entire global financial system.

On a recent Friday, traders ready to make billion-dollar bets woke up to… nothing. Frozen screens. Dead air. The cause wasn’t a market-pummeling scandal or an alien invasion (though that would’ve been cooler). Nope. It was the financial equivalent of a busted thermostat. A single data center in Chicago, operated by CyrusOne, got a little too toasty, and the world’s futures trading platform, Globex, decided to take an unscheduled nap. This was a classic data center outage.

Let’s be real, data centers aren’t exactly the stuff of blockbuster movies. But stick with me, because this story is a surprisingly wild ride into the fragile plumbing of our digital world.

What Exactly Happened? Anatomy of a Meltdown

Alright, let’s put on our detective hats and solve the case of the comatose commodity market. It’s less CSI: Miami, more CSI: Suburbs of Chicago.

- The Victim: The CME Group (Chicago Mercantile Exchange), which is basically the planet’s biggest casino for professionals betting on everything from the S&P 500 to the price of pork bellies. (Yes, really.)

- The Crime Scene: The Globex platform, CME’s all-powerful electronic trading engine. Before the market even opened, it just… didn’t.

- The Culprit: A cooling system failure. I’m not kidding. The A/C broke.

Here’s the thing your high school science teacher probably skipped: data centers are packed with thousands of servers that generate more heat than a dad at a thermostat. They require massive, specialized air conditioning systems to keep from, you know, melting into a puddle of silicon goo.

When the cooling went kaput, the servers started sweating. To prevent a full-on hardware apocalypse, an automatic safety switch flipped, shutting everything down. In this case, “everything” meant one of the most important financial trading platforms on Earth. Cue dramatic pause.

The Ripple Effect: A Freeze Across Global Markets

“Futures trading” sounds like something a sci-fi villain would monologue about, but its temporary death had very real consequences. Think of it as the world’s economic weather forecast suddenly going dark.

Equity Futures

Contracts like the S&P 500 futures are the market’s morning coffee. Traders in Asia and Europe use them to guess which way the wind is blowing in the U.S. When they went dark, it was like a global “Are you awake?” text that was left on read. Awkward and unnerving.

Bond and Interest Rate Futures

Treasury futures are the financial world’s North Star. They’re used to price almost everything else. Halting them is like telling every ship at sea that compasses no longer work. Banks and big companies suddenly couldn’t protect themselves from economic shifts, leaving them uncomfortably exposed.

Commodity and Currency Futures

The shutdown also iced the markets for actual, physical stuff.

- Energy: No trading for crude oil. The world’s gas tank was locked.

- Metals: Gold, the go-to panic asset, was untradeable. A little ironic, no?

- Agriculture: Even corn, soybeans, and wheat futures were frozen. My 7-year-old asked if he was done hearing about the price of corn. I said, “Never.”

- Currencies: Can’t trade Euros or Yen? Good luck running a global business.

For traders needing to get out of a position before the weekend, it was an absolute nightmare. Their money was trapped, leaving them to just sit there and pray no major world event happened. You feel me?

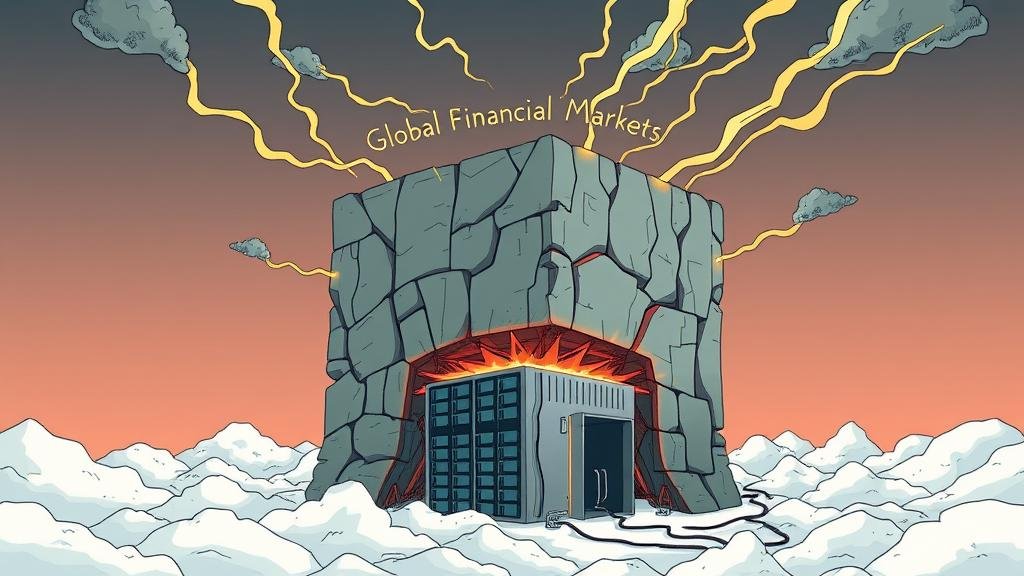

The Achilles’ Heel: Our Dependence on Data Centers

This whole debacle throws a harsh spotlight on the fact that “the cloud” is just someone else’s computer in a big, air-conditioned shed. We imagine markets as ethereal digital signals, but they live in very real buildings that can have very real plumbing problems.

Hot take coming in 3…2…1… Why didn’t a backup system just take over? That’s the multi-billion-dollar question. While these places have disaster recovery plans that would make a doomsday prepper blush, this proves no system is perfect. It raises serious concerns about systemic risk. Turns out the global economy’s Achilles’ heel isn’t a shadowy cabal; it’s a faulty HVAC unit.

This isn’t even the first time this has happened. A similar data center outage hit CME Group a few years back. The fact that it happened again means some folks are about to face some very awkward questions from regulators. Still reading? Wow. You’re officially my favorite.

What This Means for You: Our Two Cents

While Wall Street was having a collective panic attack, what does this mean for the rest ofus? Let’s break it down, uncle-style.

For the Active Trader:

This was a brutal lesson in operational risk—the fancy term for “stuff that can go wrong that isn’t the market itself.” It’s like showing up to the Super Bowl only to find the stadium is locked and the players are stuck in traffic. It proves your biggest risk isn’t always a bad trade; sometimes it’s just being unable to trade at all.

For the Everyday Investor:

If you have a 401(k) or some ETFs, you can unclench. A one-day data center outage like this likely had zero direct impact on your long-term savings. But it is a chilling reminder of the system’s hidden fragility. It’s like learning that the foundation of your house is held together by some very sophisticated, but ultimately fallible, duct tape.

For the Financial Industry:

This is what we call a “resume-generating event.” It’s a massive wake-up call that will launch a thousand angry memos and a renewed push for making the system’s plumbing—its data centers—practically indestructible, and a serious review of disaster recovery plans.

A System Bracing for a Digital-First Future

So, the great financial crisis of the day wasn’t caused by a wolf on Wall Street, but by a hot box in Chicago. It’s a hilarious, if terrifying, reminder that for all our advanced algorithms and quantum computers, our digital world still rests on a very physical foundation.

The takeaway is simple: resilience isn’t just a buzzword; it’s everything. As our economy becomes more digital, the strength of our data centers is as important as the strength of our banks. And the most important lesson of all? Never, ever underestimate the power of good air conditioning.

And yes, this will be on the test.