The Fed’s Next Move: Navigating an Uncertain Economic Outlook

Alright, let’s talk about the Federal Reserve. No, don’t leave! I promise this will be more fun than watching paint dry. Maybe.

The Fed’s upcoming decision on interest rates is shaping up to be the season finale of a reality show nobody asked for, but we’re all addicted to anyway. For weeks, we’ve been waiting for a clear signal on the economic outlook, and what we’ve gotten is the equivalent of a Rorschach test. One person sees a butterfly, another sees their portfolio crying for help.

What was once a sure-thing rate cut next month now has the odds of a coin flip. Why? Because FOMC officials are disagreeing more than my kids over who gets the last cookie. They’re all looking at the same jumbled data—from inflation reports to the job market—and coming to wildly different conclusions. Is the big bad wolf stubborn inflation, or is it a job market that’s starting to look a little sleepy? Depends on who you ask.

Let’s unpack this glorious mess.

A Divided Fed: More Disagreements Than a Family Holiday Dinner

This lack of clear data is just pouring gasoline on an already raging fire of internal disagreement. As the Associated Press put it, there are “sharp disagreements” at the Fed. This isn’t just about whether to have pineapple on pizza; it’s a fundamental debate over which economic monster is hiding under the bed.

Cue dramatic music.

- In one corner, you have Team “Inflation is the Ultimate Villain.” They argue that cutting rates now would be like inviting Dracula in for a snack after you’ve spent two years boarding up the windows. They see inflation as that party guest who just won’t leave, and they think the economy can handle high rates a little longer.

- In the other corner is Team “Don’t Kill the Job Market.” They’re seeing signs the economy is slowing down and are worried that keeping rates this high will tip us into a recession. They’re basically the worriers of the group, looking at every slowdown and saying, “See? I told you so!”

This division is why your stock market app has been giving you whiplash. The uncertainty makes the next Fed meeting a total nail-biter.

The Shutdown’s Shadow: A Blind Spot for the Fed

You know what really throws a wrench in the whole “making multi-trillion-dollar economic decisions” thing? A government shutdown. The Bureau of Labor Statistics had to hit pause on the October jobs report, leaving the Fed flying with one eye closed and a bird hitting the windshield.

Let’s be real, the jobs report isn’t exactly Netflix material. But for the Fed, it’s the holy grail. It’s the detailed diary of the economy, telling them who’s getting hired, how much they’re earning, and whether the labor market is hot, cold, or just right. Without it, the Fed’s economic forecast is murky at best. It’s like trying to bake a cake without knowing if you have flour. Good luck with that.

This data blackout is a problem. The Fed’s been hiking rates to cool things down, and the jobs report is their thermometer. A strong report says, “Keep your foot on the brake, pal.” A weak one whispers, “Maybe ease up before we drive off a cliff.” Without it, they’re relying on other clues to guide their monetary policy, which is a bit like diagnosing a patient based on their Zillow browsing history.

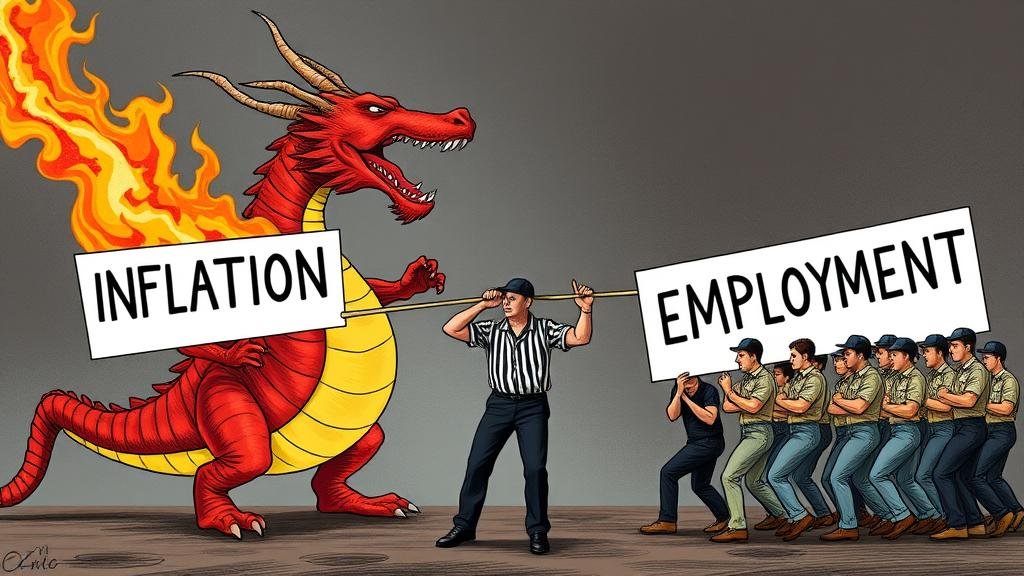

The Tug-of-War: Inflation vs. Employment

So, the Fed’s monetary policy is stuck in a classic economic tug-of-war. Let’s call it Godzilla vs. Full Employment.

The Inflation Picture

Now, before your eyes glaze over like a Krispy Kreme, let’s talk inflation. It has definitely chilled out from its 2022 rage-fest, but it’s still hanging around, loitering above the Fed’s 2% target. The latest reports are a mixed bag—some prices are down, but others (especially in services) are being incredibly stubborn.

The big fear? Cutting interest rates too soon could wake the inflation dragon, and nobody wants to fight that thing again. That would mean even higher rates down the road. Yikes.

The Employment Picture

Even without the official jobs report, we’re getting hints that the job market is taking a breather. Fewer job openings, fewer people rage-quitting their jobs—these are signs the tight labor market is finally loosening its grip.

This is what the Fed wanted! A cooler job market should lead to slower wage growth, which helps tame inflation. But there’s a fine line between “cooling” and “freezing.” If things slow down too much, we’re talking layoffs and a full-blown downturn. It’s a delicate balance, and the Fed is walking a tightrope in clown shoes.

What This Means for You and Your Wallet

Okay, enough Fed drama. What does this mean for your actual, real-life money? Still reading? Wow. You’re officially my favorite.

- Mortgage Rates: If the Fed keeps interest rates high, so will mortgages. Not great news if you’re hoping to buy a house without selling a kidney.

- Car Loans: Same story. Higher rates mean your new ride will cost you more each month.

- Credit Card Interest: Your credit card’s APR is probably still sky-high. Now is an excellent time to tackle that debt like it personally insulted your family.

- Savings Accounts (The Good News!): On the bright side, your savings account is finally pulling its weight. High-yield savings accounts are offering returns that actually feel, you know, high. Get that money!

- The Job Market: This is the big kahuna. The Fed’s decision could mean the difference between a stable job market and a shaky one.

The Bottom Line: Navigating the Fog

So what’s the big secret plan? Hot take coming in 3…2…1… there isn’t one. The Fed is in a tough spot, and for now, uncertainty in the economic outlook is the name of the game.

Our advice? Focus on what you can control. Shore up your emergency fund, chip away at high-interest debt, and maybe hide your credit cards from yourself for a bit. Staying informed is your superpower. By understanding the chaos, you can make smarter moves.

The next few weeks are critical. The Fed will be watching the data like a hawk (or a dove, depending on who you ask). For now, we wait. And yes, this will be on the test.