The G7’s $50 Billion Gambit: How Frozen Russian Assets Are Funding Ukraine

In a landmark financial decision, global leaders are advancing a complex plan to provide significant financial aid to Ukraine. The strategy involves leveraging the profits generated by frozen Russian sovereign assets to secure a substantial loan for Kyiv, bypassing the legal and political hurdles of outright seizure.

At the heart of the proposal is not the confiscation of the nearly $300 billion in Russian central bank funds, which were immobilized following the 2022 invasion, but rather the utilization of the interest and profits these assets generate. This “windfall” income would serve as collateral for a large-scale loan to support Ukraine’s wartime economy and defense. It is an intricate financial maneuver designed to deliver crucial aid without triggering a systemic crisis in the global banking system.

The Challenge of Russia’s Immobilized Sovereign Wealth

Following Russia’s full-scale invasion, Western nations froze approximately $300 billion in Russian central bank reserves. The majority of these funds, over $200 billion, are held in Euroclear, a Belgian securities depository. For over two years, these assets have remained in a state of financial limbo—legally owned by Russia but inaccessible.

However, these immobilized assets are invested and continue to generate substantial returns, estimated at €3 to €5 billion annually. The initial proposal to seize the principal and transfer it to Ukraine, while morally appealing, was fraught with legal complexities. Opponents, including the European Central Bank, raised concerns that seizing another nation’s sovereign assets would set a “dangerous precedent.” Such a move could undermine the principles of the global financial system, potentially causing major economic players like China to withdraw their reserves from Western economies and destabilizing the Euro and the dollar.

Unpacking the G7’s Innovative Proposal

To circumvent these risks, the G7, with strong backing from the US, has developed a more nuanced approach. Instead of seizing the principal, the plan focuses on repurposing the profits it generates.

The mechanics of this financial strategy are as follows:

- Isolate the Profits: The annual profits from the frozen assets are separated. The legal justification for seizing these proceeds is considered more robust, as they are a direct result of the sanctions imposed.

- Collateralize a Loan: This future stream of profits is used as collateral to secure a much larger, immediate loan for Ukraine.

- Deliver a “Mega-Loan”: By leveraging these future earnings, the G7 can provide Ukraine with a loan of approximately $50 billion. This ensures a significant and predictable infusion of capital to sustain its defense and economy.

This innovative workaround provides substantial support to Ukraine without direct cost to Western taxpayers, addressing potential “funding fatigue” and strengthening political resolve.

High Stakes and Hurdles: A Path Paved with Challenges

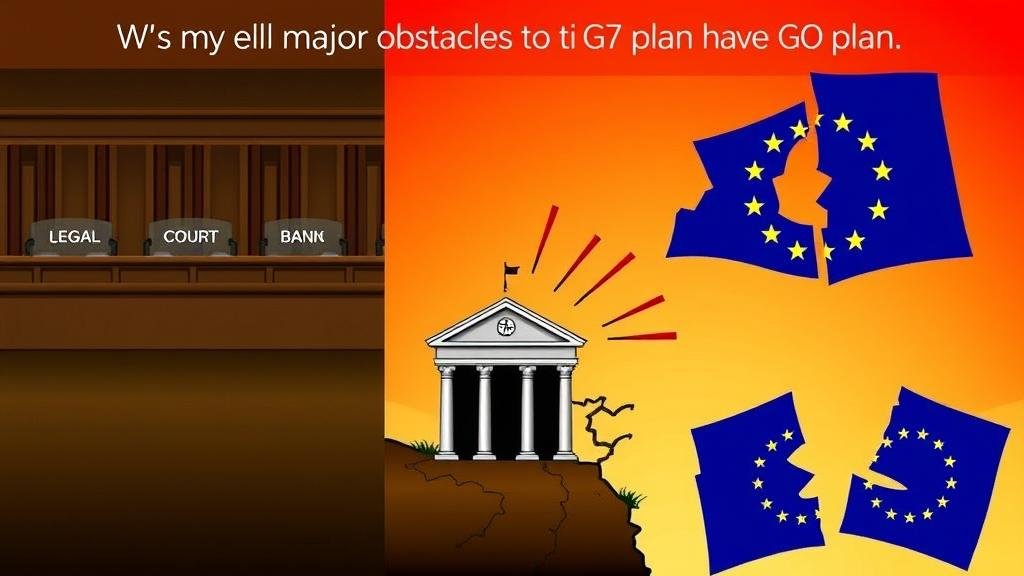

Despite its ingenuity, the plan faces considerable obstacles.

Legal Labyrinths

The legality of using the profits, while on firmer ground than seizing the principal, remains in uncharted territory. Russia has condemned the plan as “outright theft” and has vowed to retaliate with legal challenges and the seizure of Western assets within its jurisdiction. The lack of international precedent means the implementing nations are navigating a significant legal risk.

Financial Stability and a “Dangerous Precedent”

Financial leaders in Europe remain cautious. Nations like Belgium, which holds the bulk of the assets, are concerned about the potential damage to their reputations as safe financial havens. If the West establishes new rules for seizing profits from sovereign funds, it could erode trust in the Euro and the broader European financial system, prompting other countries to reconsider where they hold their foreign reserves.

The Quest for Unity

The plan requires unanimous consent from all 27 EU member states, a notoriously difficult diplomatic feat. Politically motivated vetoes from member states with closer ties to Moscow, such as Hungary, remain a persistent threat to implementation.

Conclusion: A Financial Gambit with No Easy Answers

The G7’s plan to leverage the profits from frozen Russian assets is a critical, albeit risky, effort to ensure Ukraine’s continued solvency and defense. This is more than an accounting maneuver; it is a clear message to Moscow of the West’s long-term commitment.

The success of this financial gambit hinges on the ability of Western leaders to navigate a complex legal minefield, maintain unity, and accept the inherent risks to the global financial order. The upcoming G7 and EU summits will be pivotal, not just for Ukraine’s future, but for the evolution of international finance and economic statecraft.