The Vicious Cycle: Government Spending, Inflation, and Your Investment Strategy

The Vicious Cycle: Government Spending, Inflation, and Interest Rates

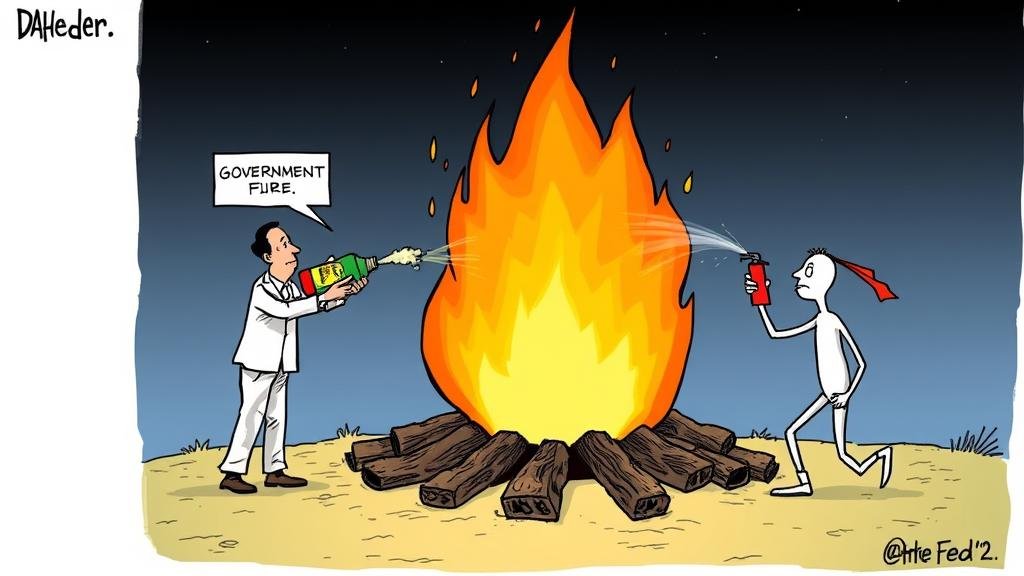

Let’s break this down without needing a PhD in economics. Imagine the economy is a campfire. The government, in its desire to keep everyone warm, decides to pour a giant can of gasoline on it. This is your stimulus checks, massive infrastructure projects, and “let’s-solve-everything-with-money” programs.

For a moment, it’s great! The fire is HUGE. But then, the inferno starts getting too close. That’s inflation. Suddenly, your marshmallows cost $50 a bag. This is where sound financial planning becomes critical.

Enter the central bank—the responsible park ranger. The ranger sees this bonfire-gone-wild and starts spraying it with a fire extinguisher. That’s an interest rate hike. And another. The Federal Reserve has hit us with 11 of these hikes, trying to douse the flames of inflation.

The problem? The government is still standing there with more gasoline. The government is essentially “fighting the Fed.” It’s like watching two cooks in the same kitchen—one turning up the heat while the other sprays everything with a fire hose. You, the investor, are just hoping your portfolio doesn’t get scalded.

The Investor’s Dilemma: Navigating the New Economic Landscape

So, what does this glorious mess mean for your hard-earned cash and wealth management plan? It’s a full-on stress test for your investments.

The Squeeze on Stocks

For the last decade, low interest rates made the stock market feel like a party. Well, the lights just came on.

Higher interest rates are a buzzkill for stocks because:

- Borrowing Isn’t Fun Anymore: Companies swimming in debt now have to pay more for it. That eats into profits, making their stock less appealing.

- The Future is Worth Less Today: The value of a growth stock is based on future earnings. When rates go up, that far-off money is worth less right now. It’s bad news for your favorite tech darlings.

- Your Wallet is Crying: Higher rates on your mortgage and car loans mean you have less money to spend, which hurts companies’ bottom lines.

The Bond Market Conundrum

Ah, bonds. The sensible minivan of the investment world. They were supposed to be your safe space. So, why do they feel like a leaky raft in the current bond market?

Here’s the painful lesson: when interest rates go up, the value of older, existing bonds goes down. Why would anyone want your 2% bond when they can buy a new one that pays 5%? This has turned the classic 60/40 asset allocation (60% stocks, 40% bonds) into a strategy providing 100% of the anxiety.

The Real Estate Ripple Effect

Remember when you could list your house and have a bidding war break out? Those days are over. Sky-high mortgage rates have put the real estate market on ice, sending a chill through everything connected to it.

A Deeper Dive: The Psychology of Investor Sentiment

Here’s the part my therapist says I should talk about more: feelings. As a recent Axios article pointed out, people hate inflation. They also hate the main cure for it, which is jacking up interest rates.

This creates a climate of fear, or negative investor sentiment. And fear makes investors do dumb things, like selling at the bottom or yolo-ing their savings into a cryptocurrency named after a hamster. Please don’t do that.

Investment Strategies for a Shifting Market

Okay, so the world is a confusing tire fire. What now? While this isn’t official investment advice, let’s talk about some classic investment strategies for when things get weird.

- Diversification is Key: Don’t put all your eggs in one basket. Spreading your money across different assets, industries, and countries is your best defense.

- Focusing on Quality: Now is the time for rock-solid, “boring” companies with little debt and essential products (think: toilet paper or coffee).

- The Rise of Alternative Investments: Look beyond stocks and bonds to things like commodities, real estate trusts (REITs), or private equity. Just make sure you know what you’re investing in.

- The Importance of a Long-Term Perspective: Stop checking your portfolio every five minutes. History shows that investors who stick to their plan usually come out on top. Zoom out.

The Road Ahead: What to Watch in the Coming Months

If you want to keep up with this drama, here’s what to watch:

- Inflation Data (The CPI Report): This is the monthly report card on inflation. Is the government’s strategy to control inflation working?

- Central Bank Announcements (Fed Meetings): This is where the Fed tells us if they will continue to raise interest rates.

- Government Spending Plans: With elections looming, politicians will be promising new, expensive things. Keep an eye on any proposals that look like another can of gasoline heading for the campfire of government spending.

Staying informed is your best defense for solid financial planning. And yes, this will be on the test.