KPMG Insider Takes the Helm: A New Era for UK Financial Regulation?

A New Leader for the UK’s Financial Watchdog

The world of corporate governance just got a major shake-up. A former KPMG partner, a veteran of the Big Four accounting firms, has been appointed interim head of a key UK regulatory body. If that sounds dry, think of it as the financial equivalent of a plot twist in your favorite thriller. This appointment is sending significant tremors through the financial world, signaling a potential new era for financial regulation.

Forged in the Big Four

A partner at a Big Four firm like KPMG is more than just a top-tier accountant. They are the special forces of the financial world, trained to navigate the complex maze of corporate governance. They don’t just count the beans; they understand the entire supply chain, ensuring every last one is accounted for. This is the level of expertise now leading a top financial watchdog—an individual who has audited massive global companies and navigated spectacularly complex regulations.

The Watchdog’s Weighty Role

So, what does this UK regulatory body actually do? They are the designated financial watchdog for the business world. After a few high-profile corporate scandals, there were concerns the watchdog had become a sleepy chihuahua. The role of its leader is to instill confidence and enforce the rules of financial regulation. Being the “interim” head adds a unique challenge—it’s like substitute teaching a class of corporations, tasked with maintaining order while prepping for the permanent chief.

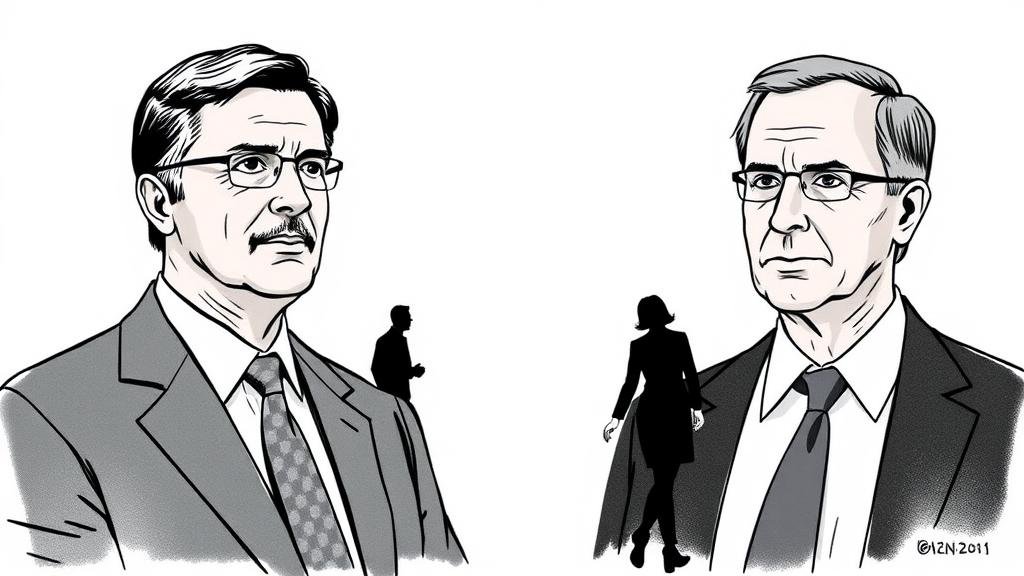

Poacher Turned Gamekeeper?

Putting a former Big Four partner in charge of the very industry they came from raises the classic “poacher-turned-gamekeeper” question. Is it a conflict of interest? Or is it a stroke of genius? The argument is that no one is better equipped to strengthen financial regulation than someone who knows every loophole and pressure point from the inside. This appointment hinges on a crucial test of loyalty: will their allegiance be to their old team or to the integrity of the game?

Challenges and Opportunities Ahead

The new interim chair faces a demanding agenda. The top priority is tackling audit quality, a cornerstone of public trust in the financial markets. The goal is to ensure that auditing is rigorous, not just a rubber-stamping exercise. This is a pivotal opportunity to strengthen the UK’s corporate governance framework, making the system more transparent and resilient against misconduct. It’s a chance to redefine the standards for financial accountability.

A New Chapter in Governance

This appointment marks a new chapter for the UK regulatory body. Placing a former KPMG insider at the helm is a bold strategy that will be closely watched. With deep knowledge of the inner workings of corporate governance, the new leader has a unique chance to fortify the UK’s financial system from within. The stage is set for a fascinating test of reform, and the entire financial world will be watching.