Netflix’s $83B Bid for Warner Bros. Discovery: A Hollywood Blockbuster in the Making

Forget ‘Succession’—the most dramatic power plays are happening on Wall Street, and they have more twists than an HBO prestige series. This is the real story of the battle for the future of entertainment.

A Bidding War of Titans: The Potential Netflix-Warner Bros. Discovery Merger

The industry is buzzing with the news: Warner Bros. Discovery is the coveted prize in a high-stakes bidding war. Netflix, the streaming giant that knows your viewing habits better than you do, threw down a colossal $82.7 billion offer. This potential media merger has set the stage for a dramatic showdown.

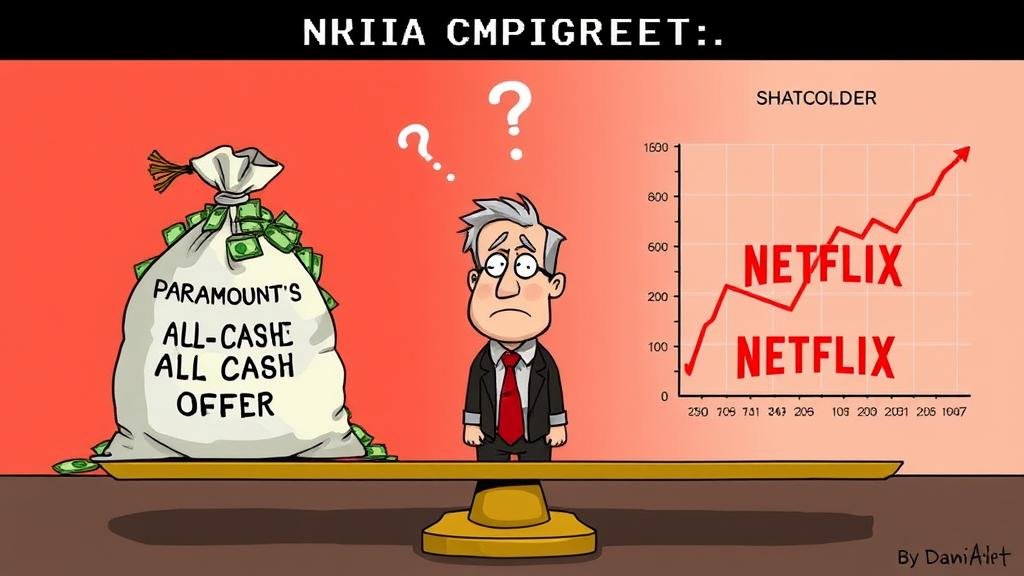

Just as the dust was settling, Paramount, backed by David Ellison’s Skydance Media, entered the scene with an all-cash “hostile takeover” bid. In simple terms, they’re going straight to the shareholders, bypassing management. It’s a bold move, and Ellison is betting that cash is king, calling Netflix’s offer “inferior.” The drama is palpable, and this Warner Bros. Discovery acquisition saga is just getting started.

The Kushner Connection: Middle Eastern Capital in Hollywood

So where is Paramount getting the capital for this aggressive play? Enter Jared Kushner’s private equity firm, Affinity Partners. His firm has reportedly amassed over $3 billion, with a significant $2 billion from Saudi Arabia’s Public Investment Fund (PIF). These are the connections he forged during his time in Washington, and now they’re making waves in Hollywood. This moment is Kushner’s high-profile entry into the world of big-league finance, blurring the lines between politics and massive financial deals. Many are watching to see if Netflix buys Warner Bros. Discovery, or if this new power play changes the game.

All-Cash vs. Stock: The Strategic Advantage

In a volatile market, an all-cash offer is a power move. It’s a guaranteed price, eliminating the uncertainty of stock swaps and market fluctuations. It’s clean, simple, and incredibly attractive to shareholders.

Paramount is also playing the long game with regulators, suggesting that a Netflix-Warner Bros. Discovery merger would be a regulatory nightmare. They’re positioning their offer as the smoother, less complicated path. It’s a clever strategy designed to win over shareholders by offering them a faster and more certain payday.

What a Streaming Giant Means for You

Why should you, the viewer, care about this corporate clash? Because the winner will create a media behemoth—a streaming giant with a content library so vast it would be impossible to watch it all.

This could lead to the ultimate dream: one streaming app with all your favorite shows and movies. From The Sopranos to Stranger Things and the entire DC universe, all in one place. The downside? Less competition could mean higher prices and fewer choices. One thing is certain: your streaming bill isn’t going down.

The Road Ahead: A High-Stakes Standoff

The situation is dynamic, with Warner Bros. Discovery shareholders caught in the middle of two competing offers. The coming weeks will be filled with corporate maneuvering and backroom deals, making this a geopolitical thriller with global implications. The final chapter of this media merger is unwritten, but it’s guaranteed to be a blockbuster.