Nvidia’s AI Boom: Are We in a Tech Bubble or at the Start of a Revolution?

For months, Wall Street has been buzzing with the nervous energy of a cat on a hot tin roof, with one question echoing through the trading floors: “Is the AI stock rally creating another tech bubble?” It seemed like we were all bracing for a repeat of the dot-com bust. The Nasdaq, while enjoying the AI boom, seemed to be holding its breath.

Then, Nvidia, the powerhouse behind the AI revolution, stepped into the spotlight. The chipmaker, whose technology is the lifeblood of the current AI trade, didn’t just meet Nvidia earnings expectations; it shattered them. This impressive performance silenced the skeptics and propelled the Nasdaq to a significant 2.4% gain, reassuring investors.

This wasn’t just market hype; it was a surge backed by substantial profits. So, let’s set aside the AI bubble talk for a moment and delve into what this means for the stock market and for you.

The Nvidia Earnings Report That Rocked the Stock Market

To grasp why the Nasdaq celebrated, you need to see Nvidia’s stellar report card. They didn’t just pass; they set a new standard.

Let’s look at the numbers. Nvidia’s quarterly revenue far exceeded the most optimistic forecasts. The driving force behind this growth is their data center division, which supplies the highly sought-after H100 and A100 AI chips. These chips are the essential tools of the AI gold rush, and companies of all sizes, from tech giants like Amazon to burgeoning AI startups, are acquiring them at an incredible pace.

This isn’t speculative; it’s a tangible, industry-wide transformation. The market’s reaction was overwhelmingly positive. Nvidia’s stock soared, creating a “sympathy rally” that lifted other tech stocks. When the provider of essential tools prospers, it’s a strong indication that the companies using those tools are embarking on major projects. This is a powerful vote of confidence in the entire tech sector.

An AI Bubble? Nvidia’s Performance Suggests Otherwise

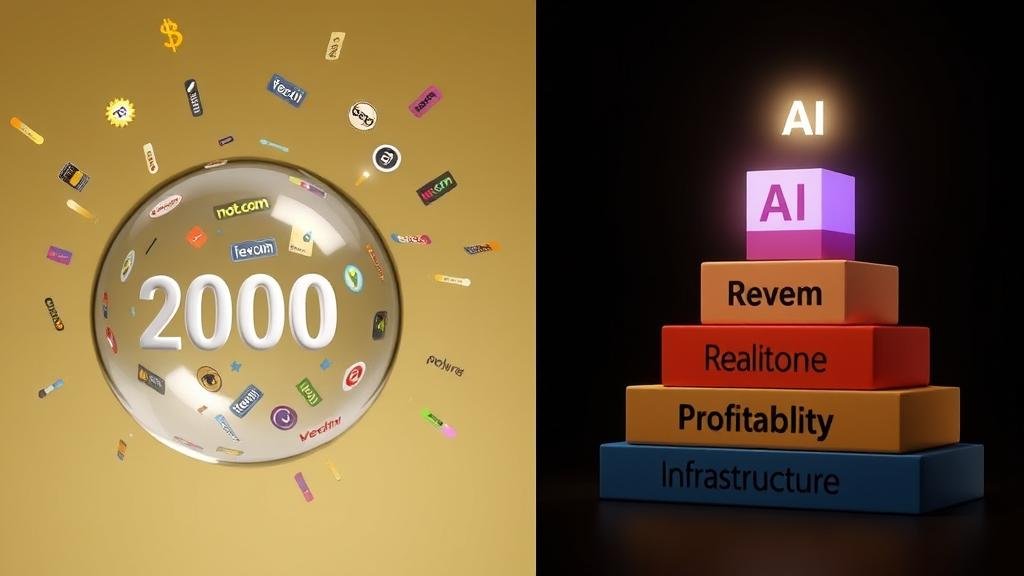

For months, financial analysts have been drawing parallels to the dot-com bubble of 2000, when companies with catchy names but no profits were valued in the billions. The fear was that the AI stock rally was a repeat of that speculative frenzy. However, Nvidia’s success highlights a crucial difference: profitability.

Here’s why this isn’t your typical tech bubble:

- Real Products, Real Revenue: Unlike the dot-com era’s vague promises, Nvidia is selling essential hardware that is in extremely high demand. Companies are placing substantial orders, demonstrating real-world investment.

- Valuations Backed by Growth: A bubble often implies that stock prices are disconnected from their real value. However, Nvidia’s explosive earnings growth justifies its high valuation for now. The earnings are growing faster than the stock price.

- An Infrastructure Overhaul: The AI revolution is more than just a new app; it’s a fundamental reshaping of corporate infrastructure. Companies are investing heavily in this long-term transition.

The market is rewarding tangible results, not just potential.

The Ripple Effect: How Nvidia’s Success Lifts the Entire Market

Nvidia has become a bellwether stock, meaning its performance influences the entire market. Here’s why its success is so impactful:

1. Confidence in the AI Narrative

Nvidia’s outstanding performance is the strongest evidence yet that the AI boom is a sustainable, long-term trend. This gives investors the confidence to support other companies in the AI ecosystem, from software developers to cloud service providers.

2. A Dose of Optimism for the Market

In uncertain times, positive news can have a significant impact. A strong performance from a market leader like Nvidia injects a dose of optimism that can overshadow concerns about inflation or interest rates. It’s a reminder that innovation can drive growth even in challenging economic environments.

3. The “Picks and Shovels” Strategy

During the Gold Rush, the most consistent profits were made by those selling tools and supplies. Nvidia is the modern equivalent, providing the essential “picks and shovels” for the AI gold rush. Its success is indicative of the health of the entire AI industry.

What This Means for You

So, how should individual investors interpret this news?

For the aggressive investor: The current momentum in AI stocks might seem like a green light to invest heavily. However, be aware that these stocks are priced for perfection, and any misstep could lead to a sharp decline.

For the cautious investor: This news confirms that exposure to the tech sector is a sound strategy. Rather than betting on a single stock, consider tech-heavy ETFs that track the Nasdaq. This allows you to participate in the AI boom while diversifying your risk.

A final piece of advice: No market grows indefinitely. While the tech bubble concerns have subsided, they haven’t disappeared. Today’s stellar performance is already priced into the stock. Diversification is key. Invest for the long term rather than chasing short-term hype.

What’s Next?

The recent rally was a victory, but the race isn’t over. Here’s what to watch:

- Future Growth: Can Nvidia maintain its incredible growth trajectory?

- The Competition: Other chipmakers are racing to develop their own powerful AI chips.

- Economic Factors: The Federal Reserve’s decisions on interest rates could either fuel or cool the AI stock rally.

The Nasdaq’s rally was a collective sigh of relief. Nvidia provided the proof that the AI boom is real, profitable, and powerful. For now, the bulls are back in charge, reaffirming the power of innovation. You’re now up to speed.