Master Your Money: A Painless Guide to Budgeting and Financial Freedom

Ah, budgeting. The adulting task that’s somehow less fun than finding a rogue Lego with your bare foot at 3 AM. I know what you’re thinking: “A blog about budgeting? I’d rather watch paint dry.” And you know what? Fair. But what if I told you that mastering your money and achieving financial freedom doesn’t have to be a soul-crushing exercise in saying “no” to everything fun?

Let’s be real, most of us treat our bank account like a horror movie. We’re too scared to look, but we know something terrifying is lurking in there, probably right after that weekend where we decided we “deserved a treat.” My 7-year-old asked if I was ever going to stop talking about responsible spending. I told him, “Never.” He just wants a pet pony; I just want to be able to afford groceries and my Netflix subscription. The struggle is real.

You feel me? Good. Let’s make this less painful and get you started on the road to smart financial planning.

The “Why Bother?” Part (Besides Avoiding Financial Ruin)

Most people think a budget is a financial straitjacket designed by sad people who hate joy. Cue dramatic pause. That’s where they’re wrong. A budget isn’t about restriction; it’s about permission. It’s your hall pass to spend money on things you actually care about, guilt-free.

Think of it this way: without a plan, you’re just throwing money into a dark void, hoping some of it lands on “rent” and “not starving.” With a plan, you’re the pilot. You decide that, yes, you can afford that vintage Star Wars lunchbox because you’ve accounted for it in your “Nerd Stuff I Absolutely Need” fund. This is the heart of good portfolio management on a personal level. See? Power.

And yes, this will be on the test.

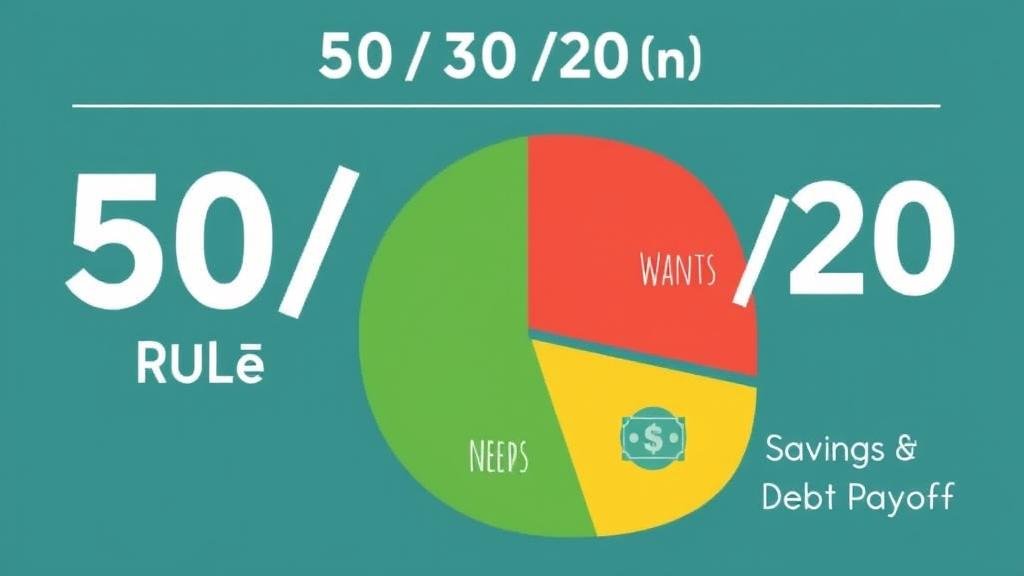

The 50/30/20 Rule: Math That Won’t Make You Cry

Now, before your eyes glaze over like a Krispy Kreme, let’s break down a super simple way to do this. It’s called the 50/30/20 rule, a cornerstone of personal financial planning. I promise it’s easier than building that bookshelf you bought three years ago. Many budgeting apps are built around this very principle.

- 50% for Needs: This is the boring-but-essential stuff. Rent or mortgage, utilities, car payments, groceries, insurance. All the things you have to pay to continue your existence as a functioning human, including tax planning. This category is the broccoli of your financial diet. You need it, even if you don’t love it.

- 30% for Wants: Hallelujah, it’s the fun zone! This is for dinners out, that new video game, concert tickets, your hobby of collecting artisanal spoons. This is where you get to live a little. My inner monologue is screaming that this category should be 80%, but my inner monologue doesn’t have to pay the electric bill.

- 20% for Savings & Debt Payoff: Here’s the “boring” part. Just kidding—it’s actually kinda cool. This is you paying Future You. Every dollar you put here is a high-five to the person you’ll be in five, ten, or thirty years. This is your fund for retirement planning and debt payoff. Future You is going to be so impressed. Or at least, not living in your kid’s basement. With the right investment advice, this portion of your budget can grow into a significant source of passive income.

That’s it. That’s the whole system. You officially know more about budgeting than 90% of the characters in any sitcom.

Hot Take Coming in 3…2…1…

Your budget is going to fail sometimes.

There. I said it. You’re going to have a month where your car breaks down or you have a moment of weakness and buy a truly ridiculous hat. It’s fine. A budget is a GPS, not a high-security prison. If you take a wrong turn, you don’t just set the car on fire and wander into the woods. You just reroute.

So you overspent on takeout this month? Okay, maybe you dial back on your “Wants” next month. The goal isn’t perfection; it’s awareness.

Still reading? Wow. You’re officially my favorite. You’ve just leveled up in adulting, and your reward is the quiet, smug satisfaction of knowing exactly where your money is going. Now if you’ll excuse me, I have to go check my budget to see if I can afford that life-sized Chewbacca statue I’ve been eyeing.