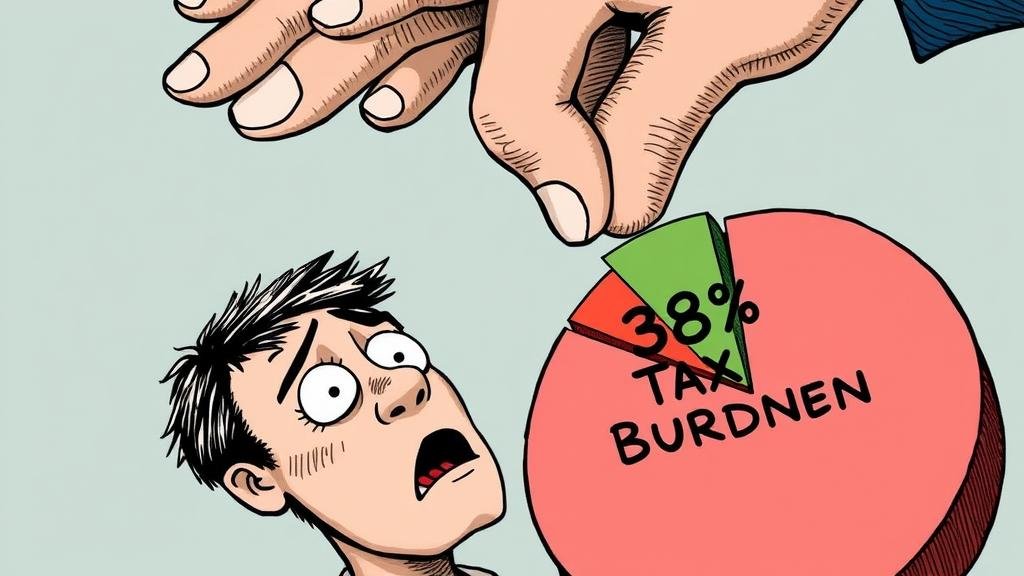

UK’s Record 38% Tax Burden: Your Guide to Surviving Stealth Taxes

The UK government has just confirmed it: the national tax burden is set to devour a whopping 38% of GDP. If you’re currently thinking, “What on Earth is a GDP and why is it eating my money?” then you’ve come to the right place.

Let’s be honest, fiscal policy announcements are usually a one-way ticket to dreamland, but this one is a bombshell. It’s like finding out your flatmate has been helping themselves to your milk, your Netflix password, and a third of your salary.

This isn’t just some abstract number for economists to debate. This is the highest level of tax in modern British history, and it’s coming for your wallet. So, grab a brew (you’ll need it), and let’s break down what this new UK tax burden really means for you.

The “Stealth” Rollercoaster to Higher Taxes

How did we get here? Gradually, then all at once. The journey to a 38% of GDP tax-to-GDP ratio has been a slow burn, a creeping realisation that your finances are getting uncomfortably tight. The government’s secret weapon in this? “Stealth taxes.”

And the most significant of these is the freeze on income tax thresholds. This is the government’s masterstroke in taking more of your money without looking like they are. It’s deviously simple. As inflation pushes your wages up, you find yourself drifting into higher tax brackets. The goalposts don’t move, but you do. Suddenly, you’re paying a higher rate of tax on your earnings without the satisfaction of a promotion. It’s a game of musical chairs where the government keeps quietly removing the chairs.

So, What Exactly Are “Stealth Taxes”?

“Stealth tax” sounds like something from a spy film, but it’s just a range of sneaky ways the taxman can dip into your pocket.

- •

Frozen Tax Thresholds: As we’ve covered, this is the limbo bar of personal finance—it never gets higher, so more and more of us get caught out.

- •

Reduced Allowances: Those useful tax-free allowances for capital gains and dividends? They’ve been given a severe haircut, meaning more of your investment income is now taxable.

- •

VAT Creep: While the main rate of VAT might not change, applying it to more goods and services is a classic move. It’s the fiscal equivalent of your child saying, “You said no more sweets, but you didn’t mention this family-sized cake.”

These subtle tweaks add up, creating a cumulative effect that leaves everyone feeling the pinch.

The Impact: Your Bank Account Wants a Word

What does this all mean for you, the average person trying to afford their weekly shop without needing a small loan?

For households, it means one thing: less disposable income. That’s the official term for “the money you actually get to spend.” With a larger chunk of your earnings going to the government, there’s less for savings, investments, or that long-overdue holiday. It’s a real squeeze on living standards, especially when the cost of everything else is already skyrocketing.

For businesses, particularly the small and medium-sized enterprises that are the backbone of the economy, it’s another blow. Higher taxes can stifle growth, discourage hiring, and dampen the entrepreneurial spirit.

The Government’s Line: “It’s for Your Own Good”

The government’s rationale is that this is a necessary evil. They argue that they need to stabilise public finances, pay down the colossal national debt, and fund essential services like the NHS and schools. Without a stable economy, they say, there can be no long-term growth.

Critics, however, argue that a 38% tax burden is less like a spoonful of medicine and more like performing surgery with a sledgehammer, fearing it will stifle the economy and drive away talent and investment.

Your Guide to Navigating the New Tax Maze

Enough of the doom and gloom. It’s time to take control of your finances. You can’t change the tax policy, but you can change your financial planning. Here’s how you can legally fight back:

- •

Review Your Financial Plan: Get serious about your budget. Understand where your money is going and how these tax changes will affect you. Knowledge is your best defence.

- •

Maximise Your Allowances: The government still offers some tax-saving opportunities. Your Individual Savings Account (ISA) is your best friend—you can save and invest in it without paying tax on the returns. Pension contributions also come with generous tax relief. Use every allowance you can.

- •

Seek Professional Advice: The tax system is becoming increasingly complex. A good financial advisor can help you navigate it and find savings you didn’t even know were possible.

The Bigger Picture: What’s Next for the UK?

This historic rise to a 38% tax burden is a big deal. It’s a reflection of the turbulent times we’ve been through. The critical question now is whether this move will stabilise the UK economy or hold it back.

We’ll be keeping a close eye on this story. The road ahead may be bumpy, but being informed and prepared is your best strategy. The conversation around tax is far from over, and it’s one we can’t afford to ignore.