The UK’s Record Tax Burden: What a 38% GDP Share Means for You

Alright, let’s talk about something exciting: the UK tax burden! *cue dramatic pause* Still here? Wow. You’re officially my favorite.

The numbers are in, and it looks like the UK’s national wallet is about to go on a crash diet. By the end of this parliament, our tax burden is set to hit a jaw-dropping 38% of GDP. That’s the highest it’s been since the late 1940s, a time when having a banana was a major life event. This isn’t just a boring statistic; it’s the financial equivalent of your favorite jeans shrinking in the wash. Things are getting tight, and it’s a key factor in the current cost-of-living crisis.

This 38% figure sounds like something you’d ignore in a meeting, but its implications are deeply personal. It’s about your take-home pay, the price of your Friday night pizza, and the economic mood music playing in the background of your life. So, stick with me. We’re going to break down what this record tax burden means without needing a degree in economics or a stiff drink (though the latter is always an option).

Understanding the 38% Figure: Is This Going to Be on the Test?

Before we get into the nitty-gritty, let’s translate the jargon. When economists talk about the “tax burden,” they mean all the tax receipts scooped up by the government (HMRC)—from your payslip, that sneaky VAT on your shopping, all of it—and comparing it to the UK’s GDP. GDP, or Gross Domestic Product, is basically the cash value of everything the country makes and does in a year.

So, 38% means that for every £100 of value created in the UK, the government politely helps itself to £38. Think of it this way: you bake a delicious £100 cake, and the taxman takes a £38 slice before you’ve even found a fork.

A bigger slice for the government means more money for the public services we like, such as hospitals and roads, but it also means less cake for us to eat or for businesses to use to, you know, bake more cakes.

And this isn’t a one-off sugar craving. The Office for Budget Responsibility (a group that sounds exactly as fun as its name suggests) predicts this number will keep climbing. This slow, steady rise is moving the UK into the “highly taxed” section of the global seating chart, which is a pretty big deal for our economic growth.

Why Are Taxes on the Rise? A Perfect Storm of “Oops” and “Oh Dear”

We didn’t get here overnight. Our journey to a near-record tax burden was less a single bad decision and more a conga line of global crises, quiet policy tweaks, and the simple fact that we’re all getting older.

The Lingering Shadow of Global Crises

Remember the COVID-19 pandemic? The government basically put the entire economy on its credit card with things like the furlough scheme. Necessary? Absolutely. Expensive? You bet. Just as we were recovering, the energy crisis showed up, leaving the nation’s finances with a massive hangover and creating a desperate need for revenue.

The Stealthy Climb of Fiscal Drag

Here’s the sneaky part. One of the biggest drivers is “fiscal drag,” which is the government’s ninja move for raising taxes. It’s not a tax hike; it’s a tax freeze. Have you ever gotten a pay rise to keep up with inflation, only to feel… poorer? That’s fiscal drag. The government freezes the income levels where you start paying higher tax rates. As your wages creep up, you get “dragged” into a higher tax bracket. It’s how the government raises billions without anyone really noticing. A stealth tax, if you will.

The Unstoppable Demands of an Aging Population

The final piece of the puzzle is a quiet one: our aging population. It means more demand for the NHS and social care. As more people retire, there are fewer working-age people to pay for it all. This isn’t a political issue; it’s just… math. And math, as we all know, is ruthless.

The Real-World Consequences: Why Your Bank Account is Crying

A 38% tax-to-GDP ratio isn’t just an abstract number; it’s the reason you have a small existential crisis in the dairy aisle.

The Squeeze on Household Finances

The most immediate effect is the squeeze on household finances. Less cash in your pocket means less for bills, savings, and the fun stuff. It makes saving for a house deposit feel less like a goal and more like a mythical quest, especially during a cost-of-living crisis.

Headwinds for Businesses and a Downgraded Growth Outlook

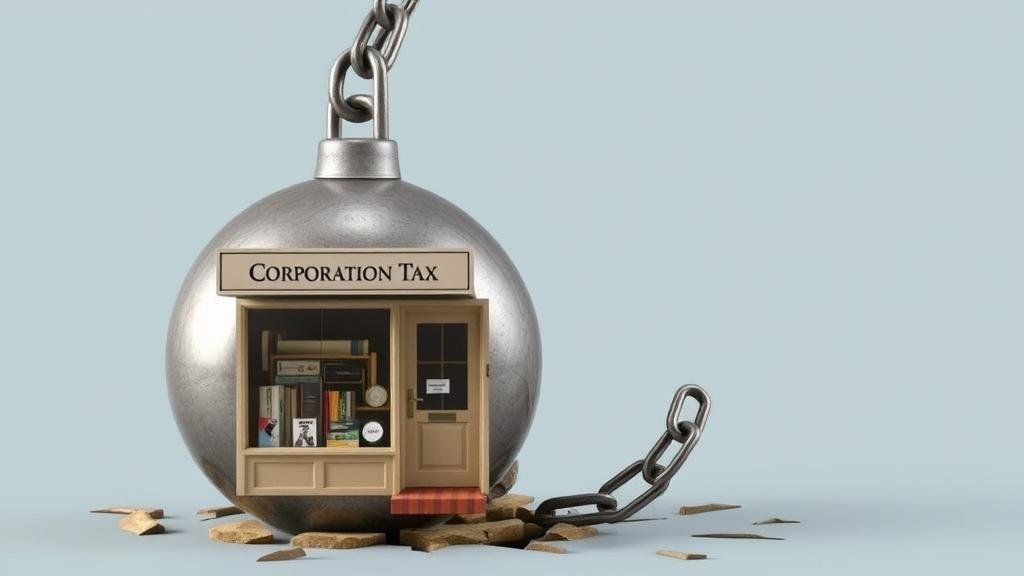

It’s not just us feeling the pinch. The high tax burden on businesses, including higher corporation tax, can be a major buzzkill for growth. It means less profit to reinvest in new ideas, better tech, or hiring. This can make the UK look less like a land of opportunity, slowing down the economy.

Navigating the High-Tax Environment: So, What Now?

The path ahead looks challenging. The government says these tax levels are needed to pay our debts and fund public services. The trade-off is a heavy burden on our wallets and a potential drag on economic growth. So what can we do? We’re not totally helpless.

The “Tell Your Mate in the Pub” Recap:

- A Historic High: Our taxes are at levels not seen since the 1940s, creating a record tax burden.

- The Culprits: A triple-whammy of post-pandemic bills, sneaky “fiscal drag” (a stealth tax), and an aging population needing more care.

- The Real Cost: A tight squeeze on household finances, headwinds for businesses, and a general economic “meh.”

Suggested Next Steps:

- Review Your Finances: It’s time to budget and figure out where every pound is really going.

- Maximize Your Tax Efficiency: Make sure you’re using every tax-free allowance out there, like ISAs and pensions. A financial advisor can be your guide.

- Stay Informed: Keep up with trusted sources to understand what’s happening with the UK tax burden. Knowledge is power.

While the high tax burden is a real challenge, understanding it and taking control of your own finances puts you back in the driver’s seat. The road ahead may be bumpy, but being a savvy, informed citizen is the best suspension you can have.