The Hunger Games of Wall Street: Your Guide to the Managing Director Promotion

It’s that time of year again. The air on Wall Street is thick with ambition and anxiety. It’s managing director promotion season, a corporate version of The Hunger Games with more spreadsheets and fewer arrows. For a select few, it’s the triumphant finish to a long race. For everyone else, it’s when they learn their career in investment banking is about to be “re-evaluated.”

So, what separates the chosen from the masses? And why is this promotion more coveted than the last slice of pizza? Let’s pull back the curtain on this high-stakes finance ritual.

The Marathon to Managing Director in Investment Banking

Becoming a managing director is a marathon, not a sprint. The journey begins with a grueling two-year analyst program where sleep is optional. From there, you climb the ladder from associate to vice president. Each step is a filter, weeding out those who don’t thrive on 100-hour workweeks.

By the time you’re a contender for an MD promotion, you’ve likely dedicated 10 to 15 years to the firm. You’ve sacrificed weekends, seen more sunrises from your desk than the beach, and generated enough revenue to buy a small island. But here’s the kicker: so has every other candidate.

More Than Just the Numbers: What the Promotion Committee Looks For

While bringing in massive revenue is your ticket to the dance, it won’t guarantee you the crown. Everyone at this level is a top performer. The real question is, what else do you bring to the table? This “what else” is the secret sauce.

- Leadership and Mentorship: Can you lead a team effectively? Have you successfully mentored junior bankers, teaching them more than just your coffee order?

- Client Relationships: Are you the first person CEOs call when they are considering a major financial move? Or are you just another contact in their phone?

- Franchise Value: Do you possess a unique skill that makes you indispensable to the bank? Or are you a one-trick pony?

- Cultural Fit: Can the other senior leaders tolerate you for three hours at a steakhouse? Are you a team player, or do you hoard deals like a dragon?

The promotion committee spends weeks on “360-degree reviews,” gathering feedback from everyone you’ve ever worked with. It’s professionally sanctioned gossip.

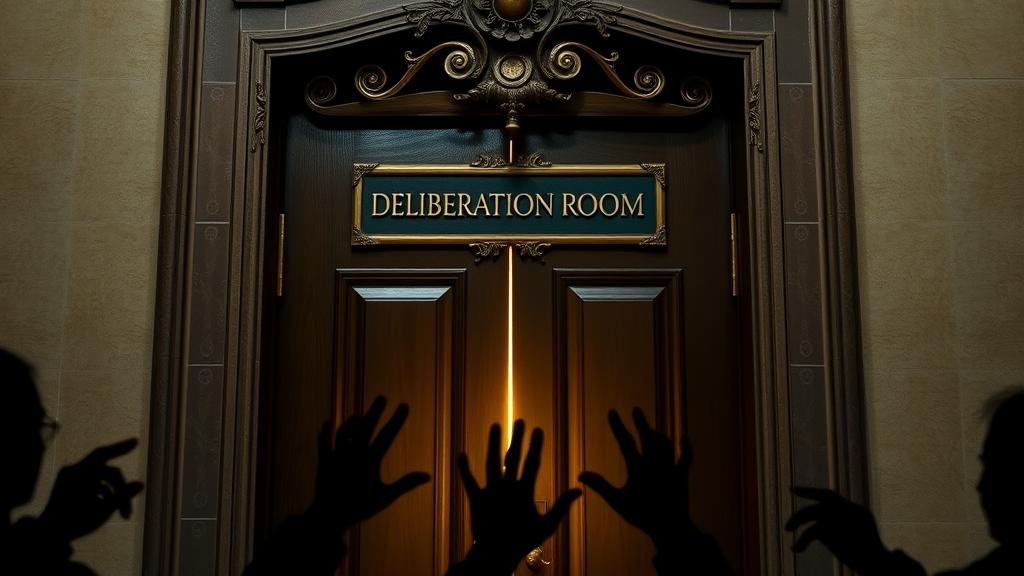

The Black Box of Deliberation

The final decision-making process is a “black box.” Senior leaders gather in a locked room to finalize the list. The debates are heated. A senior MD might champion their protégé, while a rival points out a minor fashion faux pas from years ago.

The number of available spots is a major factor. In a strong economy, the firm might be generous. But in a shaky market, the velvet rope gets shorter, and even star candidates can be left out.

The Aftermath: A Career Crossroads on Wall Street

For those who make it, the rewards are immense—a salary and bonus that would make Scrooge McDuck blush and the kind of job security that lets you buy that impractical sports car.

For those who are passed over, the “up or out” culture of Wall Street is a reality. You might be not-so-subtly encouraged to explore “external opportunities.”

It’s a tough pill to swallow, but it’s not the end. Many bankers who miss the MD promotion have successful careers at smaller firms, in private equity, or by starting their own ventures. There is life after the big bank.

The View from the Sidelines

As this year’s corporate drama unfolds, the stakes are sky-high. This process shapes the bank’s future and signals what it values most.

For the candidates, it’s the season finale of a 15-year show. For the rest of us, it’s a fascinating look into an industry that runs on caffeine, ambition, and a healthy dose of fear.