Gary Neville leads US-backed consortium in Millwall takeover

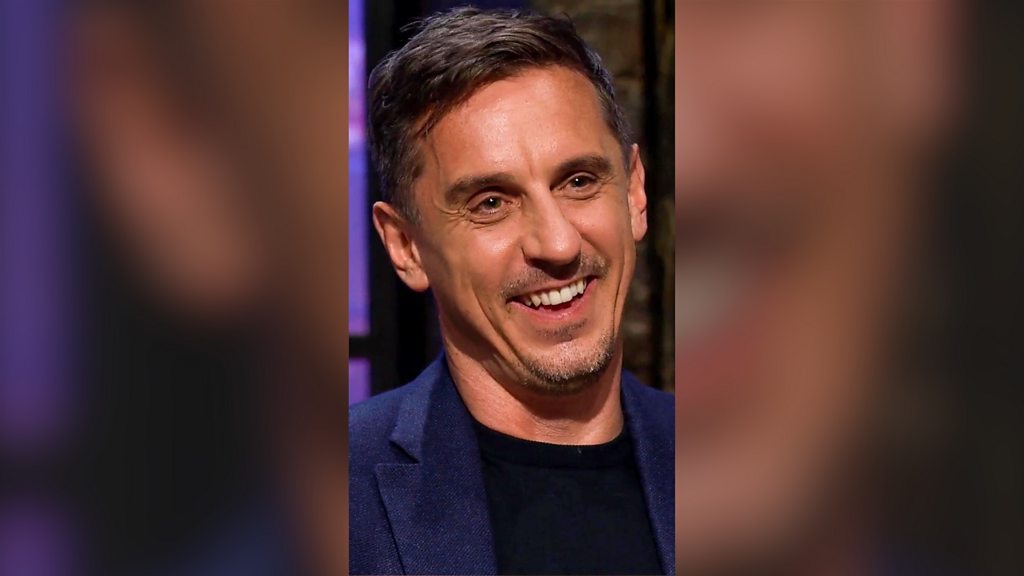

Gary Neville returns to the DenImage Credit: BBC Business (Finance)

Key Points

- •LONDON – Former Manchester United captain and prominent football pundit Gary Neville is set to take the helm at Millwall F.C., fronting a US-backed consortium that has agreed a deal to acquire a majority stake in the London-based club. The move marks a significant return to club ownership for Neville and signals a new era of strategic investment for the Championship side.

- •Valuation: The agreement values Millwall Holdings plc at approximately £55 million, a figure reflecting its stable Championship status, London location, and future development potential.

- •Acquired Stake: New Den Ventures will acquire 75% of the club's parent company, providing a clear controlling interest for decisive strategic changes.

- •Key Investors: Gary Neville will take a minority personal stake and assume the role of Chairman. The majority financial partner is US-based Orion Capital Partners.

- •Regulatory Hurdles: The deal is subject to the EFL's Owners' and Directors' Test. Sources close to the deal anticipate a smooth approval process, expected to conclude within the next 6-8 weeks.

Gary Neville returns to the Den

LONDON – Former Manchester United captain and prominent football pundit Gary Neville is set to take the helm at Millwall F.C., fronting a US-backed consortium that has agreed a deal to acquire a majority stake in the London-based club. The move marks a significant return to club ownership for Neville and signals a new era of strategic investment for the Championship side.

The consortium, operating under the name "New Den Ventures," has reached an agreement with the estate of the late John Berylson to acquire a 75% controlling stake in Millwall Holdings plc. The deal values the club at approximately £55 million, pending approval from the English Football League (EFL).

The Deal in Detail

The acquisition is structured as a partnership between Neville and Orion Capital Partners, a Miami-based private equity firm with a growing portfolio in global sports assets. While Neville will be the public face and incoming Chairman, Orion will provide the bulk of the financial capital and strategic oversight.

This transaction represents a significant shift for Millwall, which has been under the stable stewardship of the Berylson family since 2007. The sale follows a period of consideration by the family after the tragic passing of John Berylson last year.

- Valuation: The agreement values Millwall Holdings plc at approximately £55 million, a figure reflecting its stable Championship status, London location, and future development potential.

- Acquired Stake: New Den Ventures will acquire 75% of the club's parent company, providing a clear controlling interest for decisive strategic changes.

- Key Investors: Gary Neville will take a minority personal stake and assume the role of Chairman. The majority financial partner is US-based Orion Capital Partners.

- Regulatory Hurdles: The deal is subject to the EFL's Owners' and Directors' Test. Sources close to the deal anticipate a smooth approval process, expected to conclude within the next 6-8 weeks.

A New Philosophy for Millwall

The consortium's strategy, outlined in preliminary documents, focuses on long-term value creation rather than a short-term, high-risk push for promotion. The plan leverages Neville’s experience with Salford City and his analytical approach to the modern game, combined with Orion’s data-centric investment model.

The core pillars of the new strategy are designed to modernise the club's operations and unlock its latent commercial potential.

- Data-Driven Recruitment: A "Moneyball" style approach will be implemented, focusing on undervalued talent identified through advanced data analytics, aiming to build a competitive squad on a sustainable budget.

- Infrastructure and Real Estate: A central part of the investment thesis is the development of The Den and its surrounding land. The consortium plans a phased upgrade of the stadium to enhance matchday revenue and explore ancillary real estate opportunities in a prime South London location.

- Commercial Expansion: Leveraging Neville's significant media profile and network, the new ownership will seek to attract a higher tier of commercial partners and expand the club's digital media footprint to engage a wider, global audience.

- Youth Academy Focus: Significant investment is planned for Millwall's acclaimed academy, with the goal of creating a consistent pipeline of first-team talent, providing both on-pitch success and a source of future transfer revenue.

Context and Background

This move is not Neville’s first foray into club ownership, but it is by far his most ambitious. His leadership at Salford City, which he co-owns with his "Class of '92" teammates, saw the club rise from the eighth tier to the professional ranks of League Two.

Neville's Business Portfolio

Beyond Salford City, Neville has built a substantial business empire. His ventures include the "Hotel Football" and "Stock Exchange Hotel" brands in Manchester, as well as a successful property development company, Relentless. This extensive business background, particularly in property and brand development, is seen as a key asset for the Millwall project.

The Rise of US Investment in English Football

Orion Capital Partners' involvement is emblematic of a wider trend of American private equity flowing into English football. Investors are attracted by the global appeal of the English leagues, predictable revenue streams from broadcast rights, and the potential for applying US-style franchise management models to what they see as undervalued assets. Clubs including Chelsea, Liverpool, Manchester United, and Crystal Palace all feature significant US investment.

Millwall's Position

Millwall has been a consistent fixture in the EFL Championship for years, known for its passionate, loyal fanbase and a strong community identity. However, the club has struggled to compete financially with "parachute payment" assisted rivals relegated from the Premier League. The new investment aims to bridge that gap through smarter, not just bigger, spending.

What's Next?

The immediate priority for New Den Ventures is to secure EFL approval. During this period, Neville and his team will conduct further due diligence and finalise their strategic plan for the first 100 days of ownership.

Once the takeover is formally ratified, Neville is expected to be appointed Chairman, with a new board reflecting the consortium's structure. The first major decisions will likely revolve around the appointments of a new technical director to oversee the data-driven recruitment strategy and the commissioning of architectural plans for the stadium's redevelopment.

While the ultimate goal is promotion to the Premier League, the consortium's message is one of patience and sustainable growth. The success of this venture will be measured not just by league position, but by the long-term financial health and infrastructural enhancement of a historic London football club.

Source: BBC Business (Finance)

Related Articles

Nationwide Protests Against ICE Enforcement Erupt in U.S.

Thousands are protesting ICE after the DOJ declined to investigate a fatal agent-involved shooting in Minneapolis, fueling a national movement and public anger.

Venezuela Amnesty Bill Could Free Political Prisoners

Learn about Venezuela's proposed amnesty bill to release political prisoners. The move could signal a major political shift and affect future economic sanctions

Pokémon Cancels Yasukuni Shrine Event After Backlash

The Pokémon Company has canceled an event at Tokyo's controversial Yasukuni Shrine after facing international backlash from China and South Korea.

US to Lose Measles Elimination Status: What It Means

The U.S. is poised to lose its measles elimination status due to escalating outbreaks. Learn what this downgrade means for public health and the economy.